Good afternoon, Chairperson Bonds and members of the Committee. Thank you for the opportunity to speak today. My name is Doni Crawford, and I am a policy analyst at the DC Fiscal Policy Institute (DCFPI). DCFPI is a non-profit organization that promotes budget choices to address DC’s racial and economic inequities and to build widespread prosperity in the District of Columbia, through independent research and policy recommendations.

I would like to focus my testimony on the Housing Production Trust Fund, the Local Rent Supplement Program and the need to develop a housing budget that will truly meet the needs of District residents and families with extremely low incomes.

Housing Stability and Its Connection to School Performance and Racial Equity

Housing stability is the foundation of overall health and well-being for all of us. Having a safe and affordable place to call home is intrinsically connected to positive life outcomes in school performance, job retention, physical and mental health, and economic security. We know there is a lot of attention this budget season on education, so it is important to stress that 19,000 DC children face housing instability that affects their ability to succeed in school. Housing instability is correlated with lower cognitive achievement test scores and lower measures of behavioral school readiness. Children who move frequently often fall behind and drop out of school.

Creating more affordable housing also is critical to addressing DC’s racial inequities. The enduring legacies of structural and individualized racism — racist zoning and residential segregation, redlining, restrictive covenants, practices barring federal employment and access to Homestead and New Deal programs, etc. —prohibited Black families from equitably accessing the housing and employment markets for years and continue to impact all communities of color today. Nearly 90 percent of extremely low-income, severely rent-burdened households in the District are headed by a person of color and most of them are Black. Addressing housing stability for these families is truly needed as the culture of historically Black neighborhoods is at risk in the District and as Black residents are involuntarily displaced at alarming rates.

The Housing Production Trust Fund and Local Rent Supplement Program Need More Resources

As you know, the Housing Production Trust Fund (HPTF) is the District’s primary tool to finance the production and preservation of affordable housing for low- and moderate-income residents. The Mayor’s proposed budget increases the District’s investment in the Housing Production Trust Fund to $130 million, up from $100 million in each of the last four years. This is commendable and reflects an important recognition that more funding is needed for affordable housing. However, it should be seen as a first step towards fully addressing rising costs of developing affordable housing and meeting the needs of families with extremely-low incomes. Funding the Housing Production Trust Fund at $200 million would help put DC on a path to meeting the most serious affordable housing challenges over the next decade. We encourage the Council to find more one-time resources to enhance the Housing Production Trust Fund.

Additionally, DC law requires that 40 percent of Housing Production Trust Fund resources be used to serve families with extremely low incomes, which almost always requires HPTF resources to be paired with rental assistance from DC’s Local Rent Supplement Program (LRSP). Project-based rental assistance through LRSP covers ongoing operating and maintenance costs for developers and is critical to keeping tenant rents low. Yet the proposed budget includes just $1.5 million for LRSP tied to projects, far less than the $7 million needed to meet this targeting requirement.

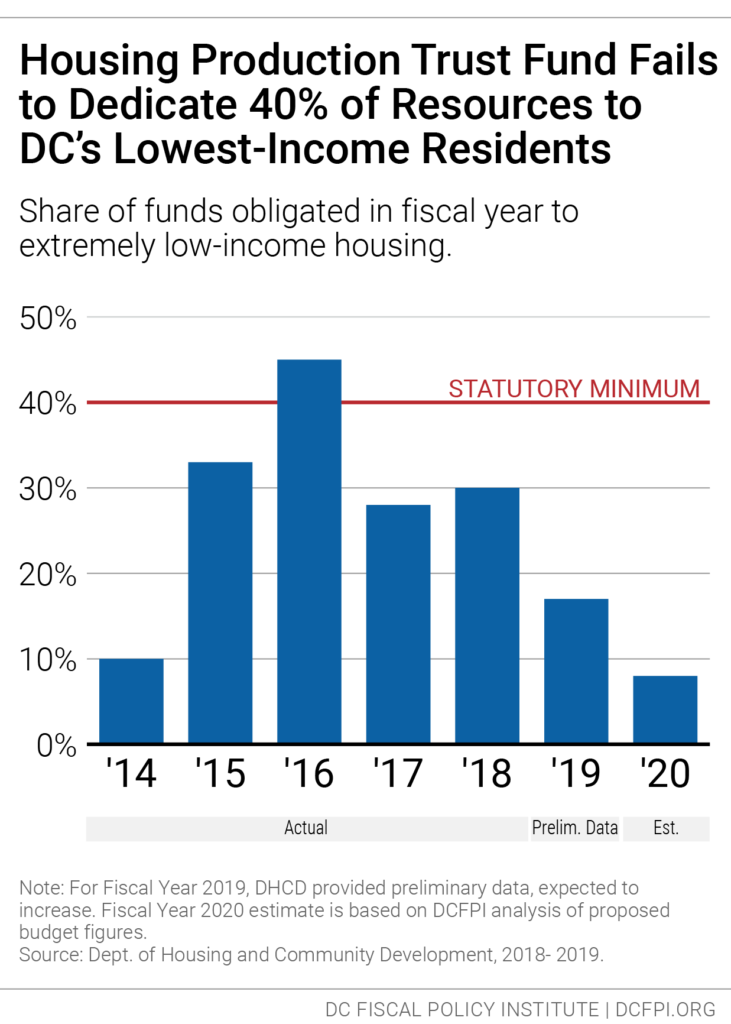

Without adequate investment in LRSP, projects built using the increase in HPTF won’t be made affordable to extremely low-income residents. In fact, the District has only met this targeting requirement once in the past five years (Figure 1). Under the proposed budget, the District would continue to fail to meet the statutory requirement that 40 percent of HPTF resources support housing for extremely low-income residents (those with incomes below $35,150 for a family of four). We estimate that under the level of project-based LRSP funding in the proposed budget, only 8 percent of HPTF-funded units will be affordable to extremely low-income families. Therefore, we encourage the Council to invest $7 million in project-based rental assistance in order to achieve HPTF statutory requirements and address severe affordable housing challenges for the 27,000 extremely low-income households spending at least half their income on housing.

Workforce Housing Program

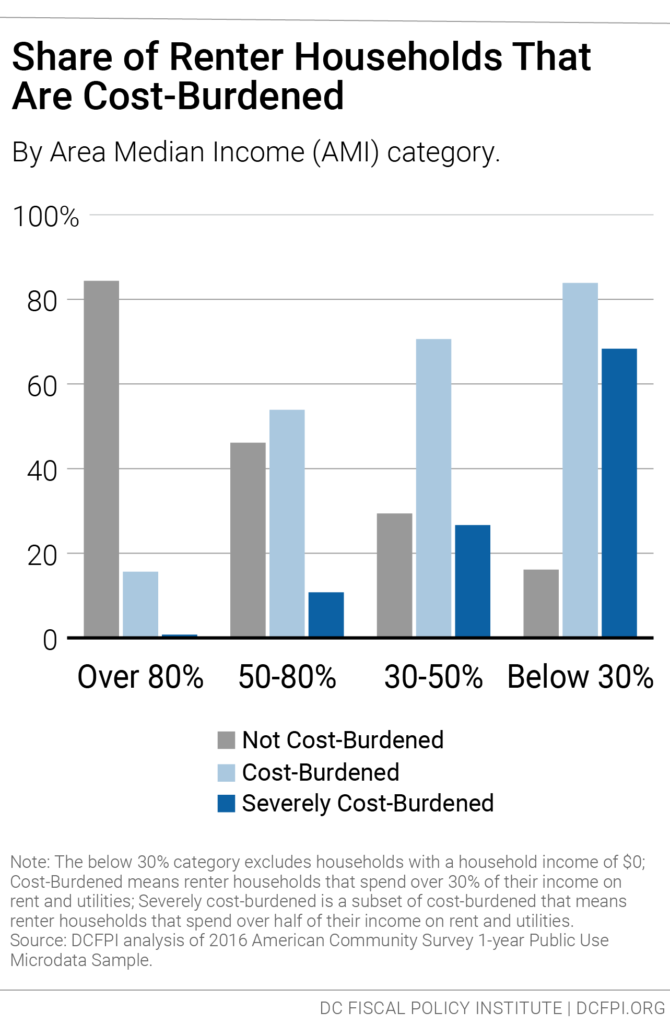

Given that this proposed budget does not provide adequate resources for public housing and affordable housing for families with extremely low incomes, we are concerned about the prioritization of a “Workforce Housing” program. While it is valid that moderate-income families also need a safe and affordable place to call home, very few families at this income level face severe housing affordability challenges (Figure 2). As a matter of equity, we should focus on getting it right for families with the greatest needs first. Until we take responsibility and consistently meet our mandated affordable housing targets for District families with the lowest incomes, any conversation prioritizing “workforce” housing for families with above-average incomes should be questioned.

DC Has the Capacity to Increase Investments in Affordable Housing

There are many ways to increase our investments in the Housing Production Trust Fund and the Local Rent Supplement Program. Three of these ways include:

- Eliminating ineffective economic tax expenditure programs for corporations: DC’s Chief Financial Officer (CFO) found that $40 million in revenue is lost every fiscal year on companies in the District that self-identify as “high tech,” which is loosely defined. The CFO was unable to identify both “what new actions were taken due to the incentives” or “what economic benefits are attributable to the incentives.” Additionally, the District has lost $29 million since 2010 on a qualified supermarket incentive intended to address food deserts. While Wards 7 and 8 comprise 82 percent of the area considered a food desert in DC and over 160,000 residents, only two of the 22 supermarkets receiving incentives opened there – and one closed shortly after opening. Most of the incentives went to supermarkets opening in Wards 1, 5 and 6 – areas that would have likely drawn a supermarket anyway.

- Levying taxes on DC’s highest-value housing: We can begin to address structural racism and structural barriers to opportunity by intentionally ushering in a more equitable tax system. In DC, everyone pays the same property tax rate. Real estate transfer taxes are the same for a home purchased for $500,000 and a home purchased for $5 million. A “mansion tax” could be levied on the wealthiest households via real estate transfer taxes and property taxes to ensure that DC’s wealthiest residents pay their fair share. Property tax surcharges, for example, could be used to generate $74 million in revenue, some of which could be used for the production and preservation of affordable housing.

- Investing DC’s surplus: The DC Fund Balance — the District’s accumulated assets including reserve funds — has nearly reached $3 billion as a result of yet another surplus at the end of last year. Unfortunately, mandates put in place by the Mayor and Council in 2010 stipulate that all available surplus funds must be placed into savings. This rule will ease when 60 days of operating reserves is reached — we’re currently just two days short. The District had a $200 million surplus in FY 2018 and all available funds —over $80 million—were put in the city’s cash reserves. Saving is important, but it is even more imperative that we reverse those rules to invest some of the growing surplus in more affordable housing for the people hurting most.

Thank you for the opportunity to testify and I am happy to answer any questions.