The structure of DC’s tax system—who pays and how much—raises issues that are important to all of us.

The taxes paid by DC residents and businesses support vital public services that make DC an attractive place to live and work. From schools to housing to parks to public transportation, these are critical to a robust economy and strong communities. DCFPI works to promote a tax system that is adequate to meet our city’s needs and fair in distributing taxes among residents and businesses.

Featured Publications & Resources

Blog

Mayor Gray: Include Property Tax Relief for Low Income DC Residents in the FY2014 Budget!

By Jenny Reed • January 9, 2013 • Revenue & Budget / Taxes

Report

Widening the Gap: New Legislation Would Further Skew Dc’s Property Tax Benefits To High Value Homeowners And Creates Tremendous Disparities In Dc’s Property Tax System

By Tina Paden • December 19, 2012 • Revenue & Budget / Taxes

Blog

Mayor Gray: Keep TIFs Within the Debt Cap

By Tina Paden • December 4, 2012 • Inclusive Economy / Revenue & Budget / Taxes

Latest on this Issue

Blog

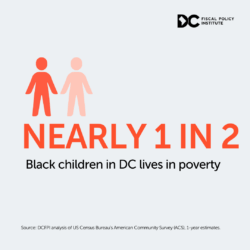

DC Tax Credits for Households with Low Incomes Will Reduce Child Poverty by One-Fifth

By Maria Manansala • December 18, 2025 • Income & Poverty / Taxes

Testimony

Mayor’s Proposed FY25 Budget Would Set Back Progress. DC Council Does Not Have to Follow Suit.

By Erica Williams • May 13, 2024 • Revenue & Budget / Taxes

Report

DC Must Grow Revenue and Spending to Pursue More Transformative Change

By Erica Williams • May 1, 2024 • Revenue & Budget / Taxes