The structure of DC’s tax system—who pays and how much—raises issues that are important to all of us.

The taxes paid by DC residents and businesses support vital public services that make DC an attractive place to live and work. From schools to housing to parks to public transportation, these are critical to a robust economy and strong communities. DCFPI works to promote a tax system that is adequate to meet our city’s needs and fair in distributing taxes among residents and businesses.

Featured Publications & Resources

In The News

D.C., please tax me more to fund recovery for all our residents

Washington Post • June 4, 2021 • Revenue & Budget / Taxes

Testimony

Testimony of Tazra Mitchell, DCFPI Policy Director, at the Public Hearing for Tax Proposals to Build Wealth Equity in the District’s Post- Covid-19 Economic Recovery DC Council Committee on Economic and Business Economic Development

By Tazra Mitchell • June 1, 2021 • Revenue & Budget / Taxes

Fact Sheets

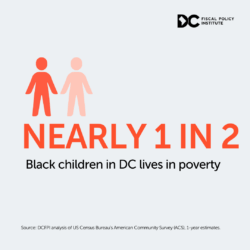

Taxing the Wealthy in DC: A Matter of Racial Justice

By DC Fiscal Policy Institute • May 19, 2021 • Revenue & Budget / Taxes

Latest on this Issue

Blog

DC Tax Credits for Households with Low Incomes Will Reduce Child Poverty by One-Fifth

By Maria Manansala • December 18, 2025 • Income & Poverty / Taxes

Testimony

Mayor’s Proposed FY25 Budget Would Set Back Progress. DC Council Does Not Have to Follow Suit.

By Erica Williams • May 13, 2024 • Revenue & Budget / Taxes

Report

DC Must Grow Revenue and Spending to Pursue More Transformative Change

By Erica Williams • May 1, 2024 • Revenue & Budget / Taxes