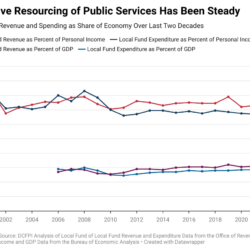

Claims that DC Spending is “Out of Control” are Wrong

While DC government should always pursue effective and efficient spending as a matter of course, common claims that the District needs to “right size” its spending, or that budget growth is out of control, aren’t rooted in reality.