Apparently, the DC Council wants to explore reducing property taxes for DC residents this year. Two such bills were introduced last week at the Council’s first meeting of 2013.

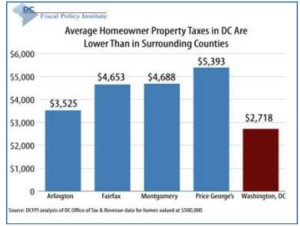

We at the District’s Dime support the idea of reducing property taxes, but we want to make sure it helps the residents who need it the most. DC homeowners already pay lower taxes than homeowners in any suburban jurisdiction, so tax cuts targeting all homeowners are not needed. But that doesn’t mean that there aren’t DC residents who struggle to pay property taxes. Indeed, low-income DC households pay a large share of their income toward property taxes ‘ and a greater share than higher-income households do.

The best approach to property tax cuts, then, would target lower-income residents facing the highest property tax burdens. The good news is that the Council already has passed legislation to do just that, although it has not been funded yet.

The average property tax on a DC home worth $500,000 was $2,700 in 2011. That compa res with $3,500 in Arlington County, $4,700 in Montgomery and Fairfax counties, and $5,400 in Prince George’s County. This stems from DC having the lowest homeowner property tax rate in the region and from other generous benefits, including a homestead deduction of nearly $70,000, and a 10 percent cap on annual tax increases.

res with $3,500 in Arlington County, $4,700 in Montgomery and Fairfax counties, and $5,400 in Prince George’s County. This stems from DC having the lowest homeowner property tax rate in the region and from other generous benefits, including a homestead deduction of nearly $70,000, and a 10 percent cap on annual tax increases.

Given this, further broad-based cuts in property taxes for homeowners shouldn’t be a high priority. Yet one bill before the DC Council would lower the annual tax cap to 5 percent for all homeowners, and another bill would freeze taxes entirely for long-term homeowners with incomes below $125,000.

Broad cuts to property taxes for homeowners have the problem that they help residents in higher-income neighborhoods far more than in lower-income neighborhoods. Half of the benefits of the 5 percent annual cap would go to residents in Wards 2 and 3, while only 4 percent would go to those living in Wards 7 and 8.

The great news is the District has a tool to target property tax assistance on lower-income families ‘ the ones most likely to be struggling to pay their bills. The DC Council passed legislation in December to improve DC’s Schedule H tax credit, and if it is funded this year, it will provide needed property tax relief to thousands of DC residents.

And Schedule H has one great advantage over other property tax relief bills: it helps renters as well as homeowners. Check out tomorrow’s blog to find out how.