Chairman Evans and members of the committee, thank you for the opportunity to testify today. My name is Jenny Reed and I am the Policy Director at the DC Fiscal Policy Institute. DCFPI engages in research and public education on the fiscal and economic health of the District of Columbia, with a particular emphasis on how policies impact low- and moderate-income families.

I am here today to testify on some of the proposed tax changes in the fiscal year (FY) 2015 budget. More specifically, I am here to testify in support of the Mayor’s proposal to create a new tax bracket for middle-incomes, as recommended by the D.C. Tax Revision Commission, and to maintain the top rate on incomes over $350,000 (or $700,000 for a two earner family).

I also want to ask that the Council fund two important tax changes in the FY 2015 budget that were recommended by the tax commission: an expansion of the Earned Income Tax Credit for childless adults and an increase in the income tax standard deduction. These are not in the mayor’s proposed budget but were placed on the budget’s “wish list,” or contingent priority list.

The FY 2015 Budget Takes Steps toward Correcting DC’s Unbalanced Tax System

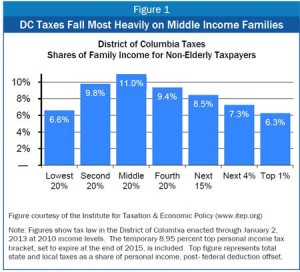

A major focus of the commission was to correct DC’s unbalanced tax system. Middle income residents pay a far higher share of their incomes in combined sales, property and incomes taxes than higher-income residents. (See Figure 1) The proposed FY 2015 budget would start to address that imbalance by including a new tax bracket for moderate- and high-income households and maintaining DC’s top tax bracket for incomes over $350,000, both of which are supported by DCFPI. More specifically:

- Income Tax Rate Reduction for Moderate- and Higher-Income Residents: The proposed FY 2015 budget would reduce the income rate from 8.5 percent to 7.5 percent on income between $40,000 and $60,000 (or $80,000 to $120,000 for two-earner families). This would reduce revenues by $25 million. The commission recommended such a step but proposed reducing the rate further, to 6.5 percent, on a wider range of income.

The proposed change would reduce taxes by up to $200 for a single-earner household and up to $400 for a two-earner household. It would reduce taxes for both moderate-income households and also for higher-income households. This is because high-income households pay the lower rates on the lower portion of their income and only pay the top rate on the portion of their taxable income that exceeds the threshold for the higher brackets. As a share of income, however, the benefit of the tax reduction will be greatest for moderate-income households.

- Maintain DC’s Top Income Tax Bracket: In order to offset some of the revenue loss from reducing income taxes on moderate-income households in the future, the FY 2015 budget also adopts the Tax Revision Commission recommendation to maintain a top income tax rate for residents with taxable incomes above $350,000 rather than letting it expire in 2016 as under current law. However, the proposed budget would keep the current top rate at 8.95 percent, while the commission had recommended lowering the rate to 8.75 percent. The difference between the mayor’s proposal and the commission is relatively modest; a family with taxable income of $500,000 would pay $300 more per year in taxes ‘ or less than one percent of income ‘ with an 8.95 percent top rate than with an 8.75 percent top rate.

Maintaining the top rate would generate a substantial amount of revenue relative to current law ‘ $20 million per year starting in 2016 ‘ that helps to offset the cost of reducing taxes on middle income residents starting in FY 2016.

To read the complete testimony, click here.