Next week, the DC Council is scheduled to vote on a comprehensive package of tax reforms, including a sales tax expansion on services ‘ the so-called “fitness tax.” The sales tax expansions are important because they make the city’s sales tax stronger and more stable and because they help pay for other provisions that provide substantial tax reductions for District residents and businesses.

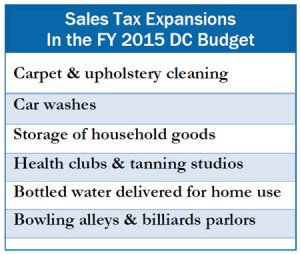

The proposals before the DC Council are based on recommendations from the DC Tax Revision Commission. Among other things, the package expands the sales taxes to services like health clubs, yoga studios, car washes, and bowling alleys. The expansion broadens the base of the sales tax, making it fairer and more reliable as our economy increasingly shifts from goods to services. For a $70 monthly gym membership, the added cost will be about $4 a month.

While it is not surprising to hear concern from those who will pay sales tax on something that has been exempt until now, there are some important things to keep in mind.

- The sales tax expansion is part of a comprehensive tax package that provides significant tax cuts for most District residents and businesses. Residents with incomes between $50,000 and $75,000, for example, will receive a tax cut of about $400. That will more than offset the roughly $50 in sales taxes on annual gym membership costs. Gyms and yoga studio owners will also benefit from significant business income tax cuts.

- Taxing health clubs isn’t anti-fitness. The Council’s tax package doesn’t create a special tax on health clubs but instead includes them in the basic sales tax. Some 22 states across the country already include health clubs in their sales tax, and DC residents already pay sales tax on exercise equipment, running shoes, and yoga mats — it is hard to argue that this deters people from exercising.

- The sales tax would not work well if it exempted everything that is good for us. The DC sales tax also applies to things like books or seeds and tools to start a vegetable garden. If the sales tax were applied only to “bad” things, it would leave the city with fewer resources to pay for things that promote public health, like bike lanes, parks, and nutrition programs.

The tax proposals before Council will make the District a fairer place, while also ensuring that DC will continue to have revenue to pay for important city services. The fact that most residents will pay lower taxes in the end should make it easier to accept paying sales tax on a few more of the things we buy.

To print a copy of today’s blog, click here.