We hope you had some fun this past weekend, or at least got some errands done. Perhaps you went out for coffee, a meal, or drinks. Maybe you went to a Nats game or saw a summer blockbuster. Or maybe you just picked up dry cleaning, went to the hardware store, or bought stuff for the home.

If you did any of these, you did something else you probably didn’t pay much attention to: you paid sales taxes. The beauty of the sales tax is that it adds a small cost to what we buy and yet generates a lot of money to pay for services we all use, such Metro, running the city’s swimming pools, or paying police officers.

However, to be effective, the sales tax needs to cover the things we buy as broadly as possible. The sales tax started out as a tax on goods because services were rare. But, over time, what we buy has shifted to include more and more services. To have a strong and fair sales tax, the sales tax base needs to keep up with what we buy.

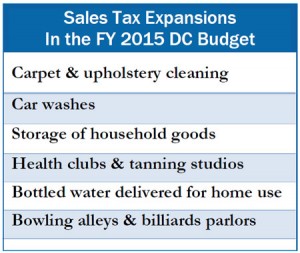

That is why DCFPI supports the DC Council’s vote last week to expand the sales tax, as part of a package implementing recommendations of the D.C. Tax Revision Commission. The list of newly covered items includes items such as bottled water home delivery and health club or yoga studio memberships.

The sales tax expansions are good tax policy, but they have raised some concerns, especially from affected businesses. Here are DCFPI’s answers to those concerns.

- Is it fair to target just a few kinds of purchases? Health clubs feel targeted only because they are among the small group of consumer purchases not taxed now. Adding gyms to the sales tax makes sense not only for base broadening but also as a matter of fairness. If a resident pays sales tax to buy weight-lifting equipment, someone who buys a gym membership should pay sales tax, too.

- Why tax something that is good for people? The sales tax generally is not intended to favor one behavior over another. (Cigarette taxes are a rare exception.) The sales tax applies to most purchases, including many things considered good for us, like books, educational toys, and garden supplies. Expanding the sales tax to gym memberships is about sound tax policy, not about discouraging residents from working out.

- Won’t people go out of DC to shop? Shoppers always look for good prices, but they also want convenience. The claim that lots of residents will drop the gym in their neighborhood or near work and travel out of the city to work out ‘ just to save a few dollars a month ‘ doesn’t sound right.

The Council’s decision to expand the sales tax helped pay for a number of tax cuts, including a reduction in the business income tax rate and income tax reductions that will benefit virtually all residents. The tax cuts far outweigh the sales tax increases, suggesting most of us will come out ahead.

The Council’s actions will make DC’s tax system stronger and fairer. We hope that is worth the price of paying sales tax on a few more of the things you buy.

To print a copy of today’s blog, click here.