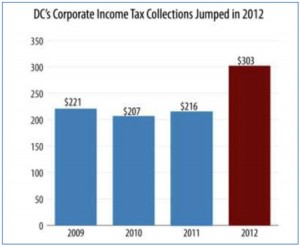

A little-noticed part of the story behind DC’s $417 million surplus is that corporate income tax collections jumped substantially in 2012. In fact, it was the largest single-year jump in 20 years. A major factor behind the dramatic increase is that DC’s leaders took steps in recent years — which DCFPI had promoted — to close tax shelters used by large multi-state corporations. The tax reform, known as “combined reporting,” was implemented in the District in 2012.

This means that DC’s finances are improving in part because the city is doing a better job of enforcing existing taxes and collecting the revenues that are due to us. That is great news.

DC’s corporate income taxes totaled $303 million in 2012, a 40 percent increase from the $216 million collected in 2011. That one-year percentage increase is the largest since 1993, The growth in collections partly reflects policy changes, such as an increase in the minimum corporate tax, but those changes were expected to bring in just $20 million. And, no doubt, a growing economy meant that more businesses had profits to report. But, the record one-year increase of $87 million is unlikely to reflect those factors alone. As Dr. Gandhi noted in his testimony on the surplus, combined reporting was a major contributing factor to DC’s improved corporate tax collections.

DC’s corporate income taxes totaled $303 million in 2012, a 40 percent increase from the $216 million collected in 2011. That one-year percentage increase is the largest since 1993, The growth in collections partly reflects policy changes, such as an increase in the minimum corporate tax, but those changes were expected to bring in just $20 million. And, no doubt, a growing economy meant that more businesses had profits to report. But, the record one-year increase of $87 million is unlikely to reflect those factors alone. As Dr. Gandhi noted in his testimony on the surplus, combined reporting was a major contributing factor to DC’s improved corporate tax collections.

Without combined reporting, large multi-state corporations can shift their reported income and profits among various subsidiaries in ways that reduce the profits reported in any given state. Beyond the problem of avoiding taxes, this also creates an unfair advantage over local businesses, which don’t have any way to shift their profits. Combined reporting requires corporations to report the income of all subsidiaries together and then apportion that total income among the states where they do business. It is viewed as the most comprehensive way to close corporate tax shelters, and is now used by 23 states and the District. DCFPI had recommended that the District adopt combined reporting for this reason.

Combined reporting was opposed by business interests in the District, as it is in every state when it is proposed. The success of combined reporting in improving tax collections should be a sign to DC policymakers that they did the right thing.

To print a copy of today’s blog, click here.