DC ran a budget surplus last year ‘ and we will find out just how much next week, when the audit for Fiscal Year 2012 is released. The surplus will be at least $140 million, and some speculate it will be as large as $400 million. The surplus will create an opportunity to make a number of important investments that would strengthen the city, including services placed on the Fiscal Year 2013 budget’s “contingent funding list” that have not been funded yet.

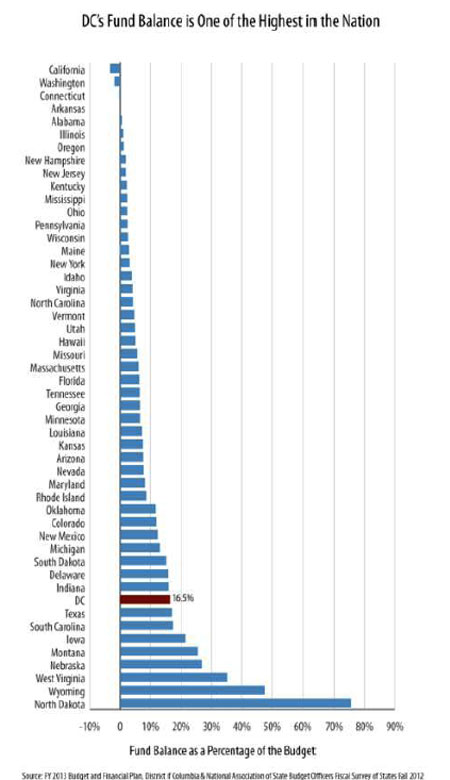

There is an obstacle to taking advantage of the surplus, however. New rules adopted in 2010 prohibit the city from using any surplus funds, even if the surplus runs as large as $500 million! While the intent was reasonable ‘ to replenish DC’s savings that fell in the late 2000s ‘ this savings-only approach seems extreme given the District’s current finances. DC’s fund balance ‘ in effect its savings account ‘ reached $1.1 billion at the end of 2011. DC’s fund balance is larger than in all but eight states, when measured as a share of the budget.

A more balanced approach to the surplus would be to save a portion ‘ such as half ‘ while using the remainder. The city’s savings would continue to grow, but the District could also use its resources on smart and needed investments. Just today, the Fair Budget Coalition put out an action alert with its suggestions for using the surplus.

- DC has significant investment needs. The adopted budget for 2013 cut funding for affordable housing production in half ‘ in the face of a huge shortfall of low-cost housing. The budget called for restoring that cut if the city’s revenue forecast improved, but that has not happened, mostly due to concerns over the federal budget ‘ leaving the housing trust fund and everything else on the contingent funding list unfunded. The surplus could be used for other things as well, generally one-time expenses. For example, the surplus could be used to pay for construction projects directly, rather than the standard practice of borrowing for such projects.

- DC’s fund balance has been used in the past as part of prudent fiscal operations: When the District experienced substantial annual surpluses in the mid-2000s, then-Mayor Williams used as much as $500 million per year in surplus funds for a variety of purposes. During that period, the city’s fund balance continued to grow or remained stable.

- DC’s conservative revenue forecasting often results in large annual surpluses. The CFO’s revenue forecasts are intentionally conservative, to ensure that the District has the funds needed to meet its obligations. This approach means that the city will end most years with a surplus. That makes it even more reasonable to plan to spend some the surplus each year.

A balanced approach to any year-end surplus makes sense. Setting aside huge amounts of city resources in savings, when savings already are sizable, is a wasted opportunity to make investments that will improve the quality of life in the District.