A deeper-than-expected drop in District revenue, due to the pandemic-ravaged economy, could mean budget cuts to education, child care, health care, and other vital services. As tens of thousands of our neighbors are out of work, going hungry, and falling behind on rent—and as small businesses close permanently—District revenues are also feeling the pinch, according to the Office of Chief Financial Officer’s (OCFO) September Forecast. The pandemic’s harm has wreaked havoc most on Black and brown residents and women in the workforce due to structural racism and a broken economic model that too often stacks the deck against them, even in good times.

Policymakers should avoid plugging the resulting budget shortfall in ways that would perpetuate harm to people, families, and others already suffering the worst of the pandemic—and suffering long before the crisis. New revenue should be part of the debate to address the budget gap, including asking more from those with the greatest ability to give—such as the wealthy who’ve largely been unscathed by the pandemic—and big businesses that are still doing well even in this deep recession.

Here are 5 things you need to know about the OCFO’s September forecast:

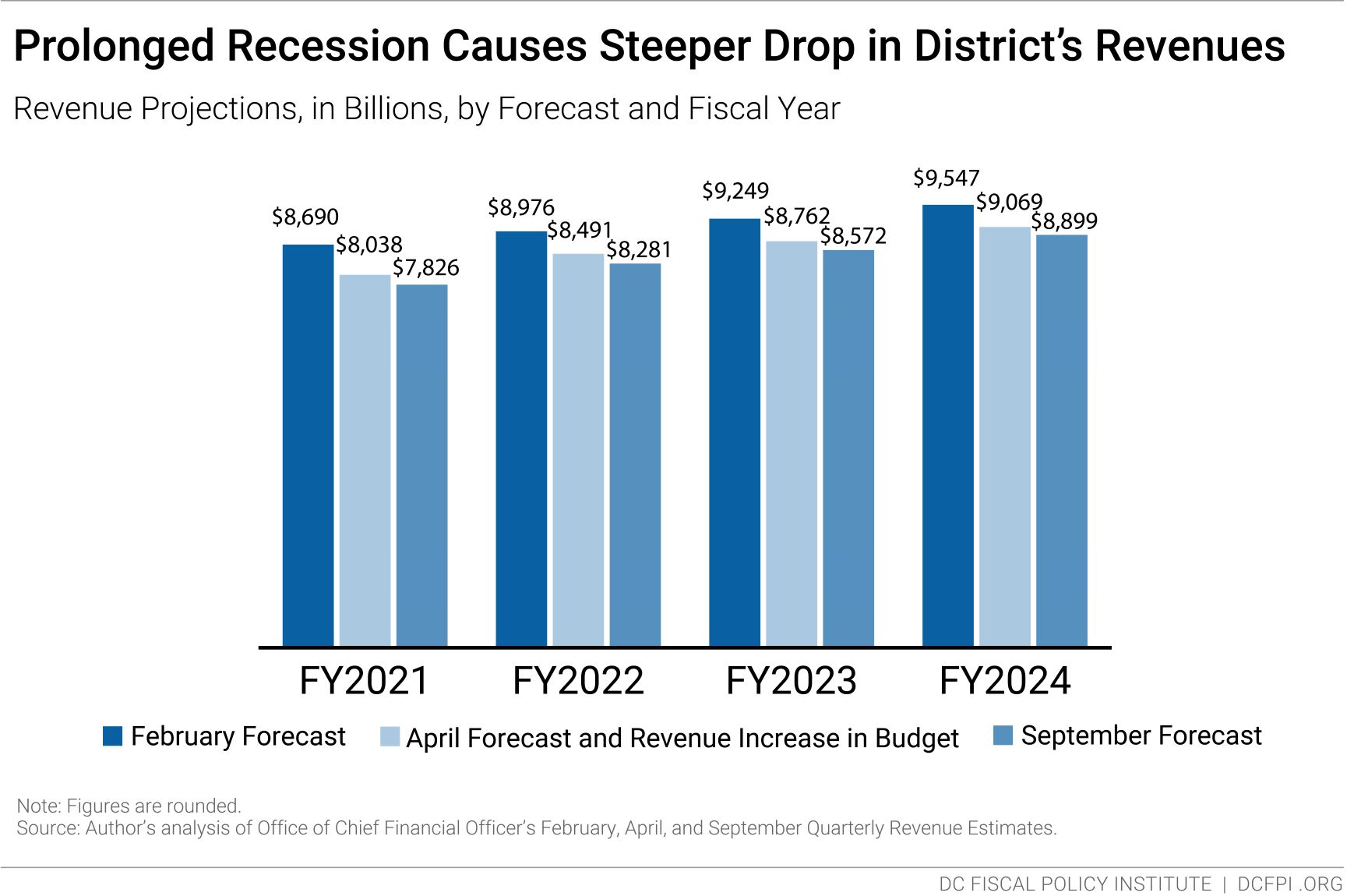

- Revenues are projected to drop by another $782 million across the 4-year budget and financial plan. Lawmakers must approve a four-year budget annually, and the OCFO publishes revenue estimates for the same period. For the current 2021 fiscal year (FY) that began in October, revenues are projected to drop by another $212 million compared to revenues estimates in July (which reflect both the April forecast and revenue increases approved in the budget). Although the total level of revenue is expected to grow modestly in each of the next three years of the plan, revenue is projected to grow more slowly due to the steep and prolonged recession (Figure 1). Compared to pre-recession estimates in February, projected revenues in FY 2021 are down by nearly 10 percent. If policymakers had not raised revenue in their approved budget this summer, the drop would have been more than 11 percent.

- DC now has a budget shortfall, but the FY 2020 surplus can help. The revenue shortfall created a budget shortfall across the four-year budget and financial plan. The Mayor and DC Council will have to pass a supplemental budget—or revision—to balance the budget, as required by law. One surprise in the September forecast is that FY 2020 revenues came in above projections by $222 million, in large part due to government intervention that stimulated the economy. The OCFO will put the surplus in the Fund Balance. The Mayor and DC Council should use that surplus to offset the revenue losses across the 4-year plan. They must identify another $560 million to close the remaining budget gap.

- Government intervention and telework options are helping, but more economic supports and stimulus are needed. The OCFO reported that substantial federal spending and Federal Reserve actions to lower interest rates prevented jobs and income from falling as much as anticipated. Public investments helped buffer the District from revenue losses through programs such as the $1,200 stimulus check, federal boost and expansion in unemployment benefits, and PPP loans for small businesses (though, they were poorly targeted). Higher-income residents have been able to better weather the pandemic due to telework options and steady paychecks as well as healthy stock portfolios. The data is in line with the evidence showing that this pandemic is triggering the most unequal recession in modern history.

- Revenues may further drop. The OCFO anticipates that the District’s revenues will begin to recover in FY 2022. However, if the District does not receive further federal aid, the recession prolongs, the stock market declines, and/or if there are delays to a widely accessible and effective vaccine beyond the end of next year, revenue collections could worsen further. Deeper revenue shortfalls would grow the budget shortfall, threatening cuts to our economy and programs that are helping residents navigate the economic pain of the recession.

- It is unclear how policymakers will plug the budget gap, or the process that they’ll use to make those decisions. The Mayor and Council can address the revenue shortfall using a combination of the FY 2020 surplus, a portion of the $1.2 billion we have in reserves, revenue increases that ask more from higher-income residents and large corporations, and any existing or new federal relief dollars that are available, among other ideas. Belt-tightening is also an option; however, that strategy is ill-advised during a recession because it does more harm to Black, brown, low-income residents, and our economy than it does It is also unclear when the Mayor will begin working on the supplemental budget, or what the supplemental process will look like. For example, in the Council, it’s unclear what roles the committees will play in amending the budget or whether those decisions will be concentrated in the Committee of the Whole.