WASHINGTON, DC — Yesterday, the US House approved its budget reconciliation bill making the biggest cuts ever made to federal funding for health and food assistance to help pay for massive tax cuts for the wealthiest Americans. The plan, which very literally takes from the poor to give to the rich, now heads to the Senate, where it is likely to undergo significant changes.

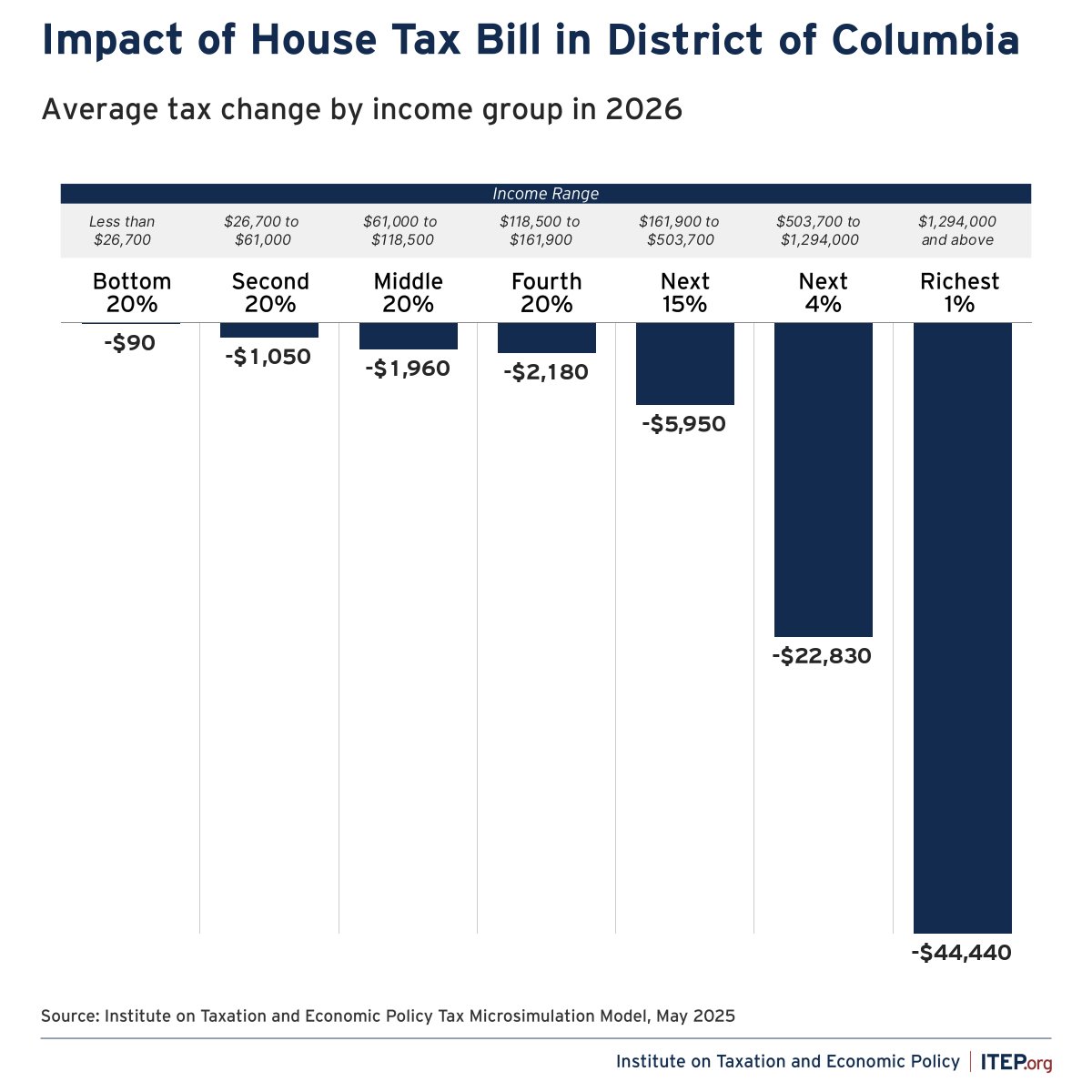

Analysis from the Institute on Taxation and Economic Policy shows that the richest 1 percent of taxpayers in the District will get the biggest tax cut—one being paid for by slashing federal basic needs programs for tens of millions of Americans.

“The inhumane reconciliation bill passed by the House of Representatives is a massive, deficit ballooning giveaway to the wealthiest Americans paid for in part by stripping health coverage and food assistance from people struggling to get by, including children, people living with disabilities, and the elderly. It also attempts to coerce many states, including DC, to end health coverage for immigrants with costly penalties,” said DCFPI Executive Director Erica Williams. “Lowering taxes for the richest 5 percent of DC residents by tens of thousands of dollars on average would dramatically increase DC’s already staggering racial wealth gap and pays for harm to at least 1 in 6 of our residents through cuts and cost-shifts in Medicaid and SNAP. While DC lacks voting representation in Congress, we are not without any tools to mitigate the damage. DC lawmakers can increase taxes on the households reaping enormous federal tax breaks to better protect our residents at a time when the federal government is failing them.”

The final House bill includes additional program changes and cuts beyond DCFPI’s initial reporting that will raise costs, increase poverty and hunger, and put health care out of reach for DC residents:

- Faster timelines on new barriers to Medicaid coverage, including harsh work and recertification requirements intended to reduce the number of enrollees; both will now start December 2026.

- Coercive penalties for states providing locally funded health coverage to undocumented immigrants now expanded to also apply to coverage of some lawfully present immigrants.

- Fewer opportunities at the federal level for creating hardship exemptions to mandatory work requirements.

- Barring of Medicaid coverage for gender-affirming care.

- More expensive premiums for health insurance plans purchased through the Marketplace.