This is something worth repeating: The taxes paid by DC residents generally are lower than in both Maryland and Virginia, often by thousands of dollars. And this is true for a wide spectrum of residents, according to a new report from DC’s Chief Financial Officer. Whether you are a moderate-income renter or a middle-income homeowner, taxes in the District are now lower than in every nearby county.

This low-tax ranking is likely to continue into the future, given that the District took steps this year to cut income taxes for most residents.

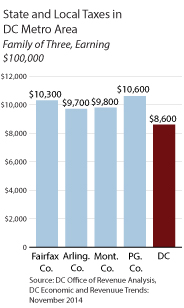

Consider a homeowner family with income of $100,000. If they live in the District, combined income, sales, property and car taxes totaled $8,600 in 2013, according to a November 2014 report by the DC Chief Financial Officer. That is over $1,000 less than in Montgomery County or Arlington County, $1,600 less than in Fairfax County, and almost $2,000 lower than in Prince George’s County.

Why are taxes on DC residents so much lower than outside the city’s border? It’s largely because the District has the lowest property tax rate for homeowners in the region and offers a number of measures to limit homeowner property taxes and their growth from year to year. DC income taxes for a family making $100,000 also are lower than in the Maryland suburbs, when both state and county income taxes are counted, and only about $300 a year higher than in Virginia, despite its reputation for income taxes that are low.

Looking into the future, taxes for DC residents are likely to drop even lower. This is because several recommendations of the DC Tax Revision Commission will go into effect in 2015 — a cut in the income tax rate for middle incomes, an increase in the standard deduction, and expansion of the Earned Income Tax Credit for the working poor. If the full set of tax commission recommendations are implemented, taxes paid by a family making $100,000 will fall $1,400, most likely creating an even bigger gap between taxes paid by DC residents and the higher taxes in the suburbs.

Having the lowest household taxes in the region may seem like a great thing. But it’s important to keep in mind that lower taxes also means less revenue that could be going to schools, health care or public safety. And a great deal of research confirms that people generally do not choose where to live based on taxes. Instead, location decisions tend to focus on factors such as jobs, schools, proximity to family, and climate.

To read the entire report, click here.

To print a copy of today’s blog, click here.