Mayor Bowser introduced a measure that would repeal DC’s status as a “sanctuary city,” which bans city agencies from assisting deportations unless there’s a judicial order. As she and the federal government escalate attacks on immigrants, DC should not overlook the many ways these residents contribute to the communities they live in and the local economy, including through their tax contributions toward DC’s shared resources.

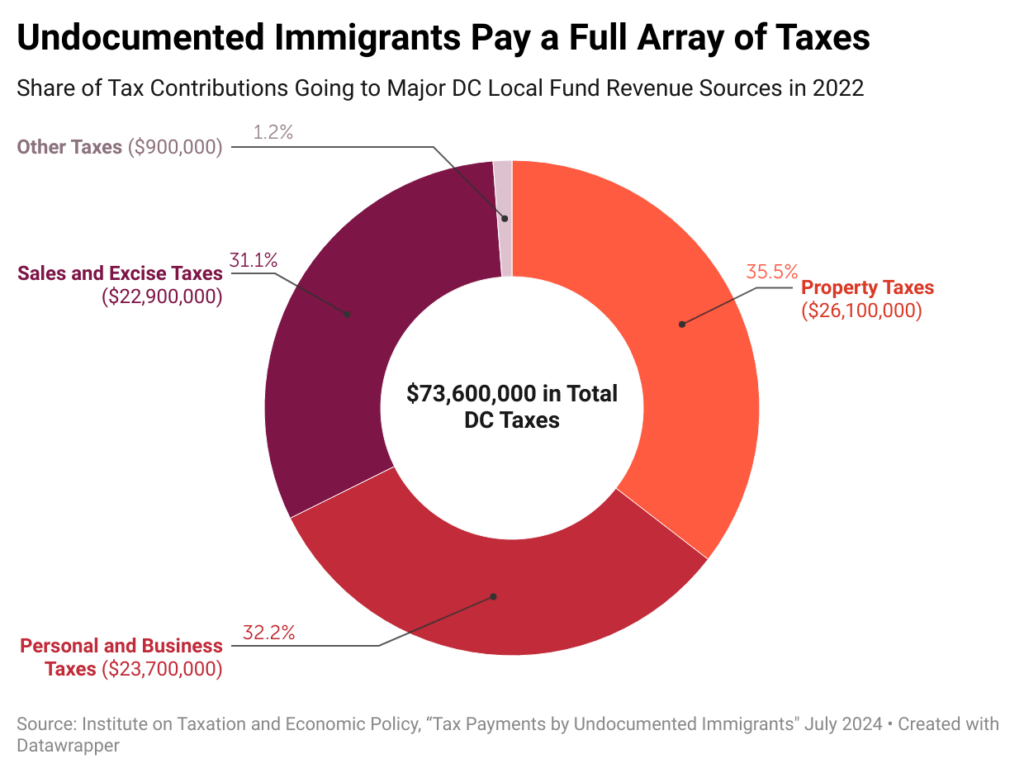

Taxes and other revenue make up the collective resources DC uses to meet its growing needs and invest in public services—like education and libraries—that allow all DC residents to thrive and reduce longstanding racial and economic inequities. Undocumented immigrants paid $73.6 million in DC local taxes in 2022, according to research from the Institute on Taxation and Economic Policy (ITEP).

Like other DC residents, all undocumented immigrants pay taxes. They pay sales taxes on goods and services such as clothes, movie tickets, prepared meals, and gas; property tax regardless of whether they own a home or rent because landlords pass on some of the tax to renters; payroll taxes via withholdings from paychecks; and, in many cases, income taxes by filing with an Individual Taxpayer Identification Number (ITIN).

In 2022, DC undocumented immigrants made most of their local tax payments through property taxes ($26.1 million), followed by personal and business income taxes ($23.7 million) and sales and excise taxes ($22.9 million) on everyday purchases (Figure 1).

ITEP found that granting undocumented immigrants work authorization would increase their tax contributions, in part because they would face fewer barriers to complying with existing tax laws, such as complicated ITIN paperwork. In DC, granting work authorization to all current undocumented immigrants would increase their tax contributions by $21.1 million per year to reach $94.7 million. (These findings are limited in that they don’t quantify the broader benefits that flow from the increased economic activity that would be created by these individuals.)

Despite their contributions to shared resources, residents who are undocumented are excluded from many public programs that they help fund, such as Social Security and Medicare, because federal law bars them from eligibility. Similarly, federal policymakers have often barred undocumented immigrants from receiving meaningful benefits from the tax system, like the Child Tax Credit (CTC) or Earned Income Tax Credit—which help families and workers with lower incomes make ends meet. In fact, the US House recently approved a measure that would strip CTC eligibility from citizen children and those with lawful permanent residency if the parents on the tax return don’t have a Social Security number (even in families with two parents and one parent is a citizen).

DC and many states have taken steps to make their programs and services more inclusive to all residents, for example in the area of health care. However, the mayor’s budget proposal for next fiscal year would retreat substantially from this longstanding commitment to ensuring residents have access to health care, no matter their immigration status. By fiscal year 2028, for example, the mayor’s budget proposal would phase in the elimination of health insurance for adults aged 21 and over via the DC-funded Health Alliance program, which serves residents who are ineligible for Medicaid, including (though not entirely) undocumented immigrants.

We all thrive when everyone can fully contribute and participate, gearing up our economic engine and moving us all forward together. DC’s economy and tax base are stronger because of immigrants, whether they are undocumented or not. How lawmakers both local and federal make policy choices that impact immigrants in the years ahead will have significant consequences for the stability and well-being of our economy and community as a whole.