It’s another busy week down at the Wilson Building as the DC Council decides how to shape the Fiscal Year 2011 budget.

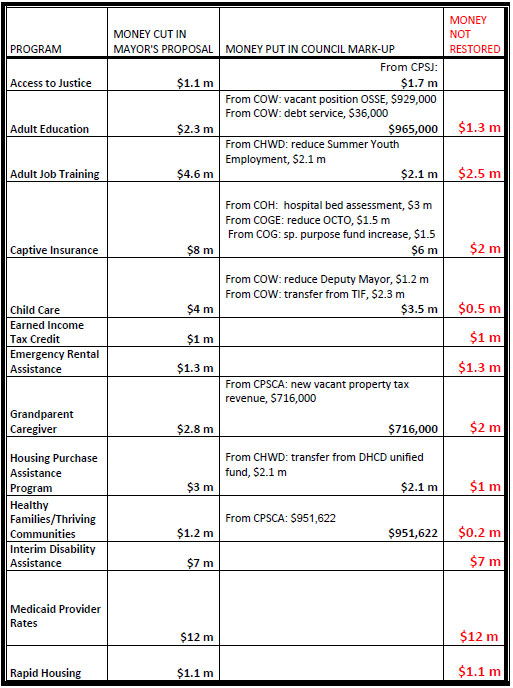

First, a few words about last week. Each of the DC Council’s twelve committees met to recommend changes to the budgets of agencies that they oversee. Known as “markups,” these meetings are the first public indication of the Council’s plans for the FY 2011 budget. We’ve highlighted some of the key changes made by the committees in the chart below. There is also a short list of proposals on revenue.

This week, the DC Council will likely meet behind closed doors to discuss the budget. DCFPI, along with 40 other organizations and individuals, have sent a letter to Chairman Gray asking him to make these meetings open to the public. The first meeting is scheduled for Wednesday.

Our “markup roundup” is below:

Revenue Proposals

Expanding the Sales Tax to Sports Tickets and Medical Marijuana: A proposal from the Committee on Libraries, Parks and Recreation would levy a tax on tickets to sporting events of 50 cents for tickets that cost $10.02-$25.01 and $1 for tickets that cost $25.02 or more. (Tickets valued at $10.01 or below would be exempt from the tax, unless more than 10,000 people attend the event.) The tax on ticket sales would be used to fund recreation programs. The Committee on Health also proposed to extend the 6 percent sales tax to medical marijuana.

Replacing a Proposed Tax on Hospitals with a Fee on Hospital Beds: The Committee on Health recommended rejecting the Mayor’s proposed 1 percent tax on hospital paient revenues and instead recommended a $1,500 assessment per licensed hospital bed. The hospital bed assessment would raise an estimated $6.3 million, compared to the $25.3 million that would have been raised by the tax on hospital revenues.

Reintroducing a Vacant Property Tax: The Committee on Public Works and Consumer Affairs recommended the reestablishment of a 5 percent tax on vacant property and a vacant property registration fee of $250. Properties actively listed for sale and rent, undergoing construction, facing economic hardship, pending predevelopment administrative review, and those subject to probate would be exempt from the tax. Last year, the Council voted to increase the tax on vacant and blighted properties to 10 percent, but later reduced the tax to 5 percent and amended the law to exclude vacant properties.

Elimination of the E911 Fee: The Committee on Public Safety and Justice recommended eliminating the mayor’s proposed E911 fee increase.