Right now, DC faces major pressures on the budget like the WMATA funding shortfall while too many residents face persistent economic hardship like high rates of food insecurity. DC lawmakers need to meet the moment by finding equitable funding sources to meet residents’ urgent needs and address extreme inequality. The DC Fiscal Policy Institute (DCFPI) recommends the tax policy proposals below to raise critically needed revenue while making DC’s tax code more equitable.

Adopt higher, marginal property tax rate for single family homes with taxable value over $1.5 million.

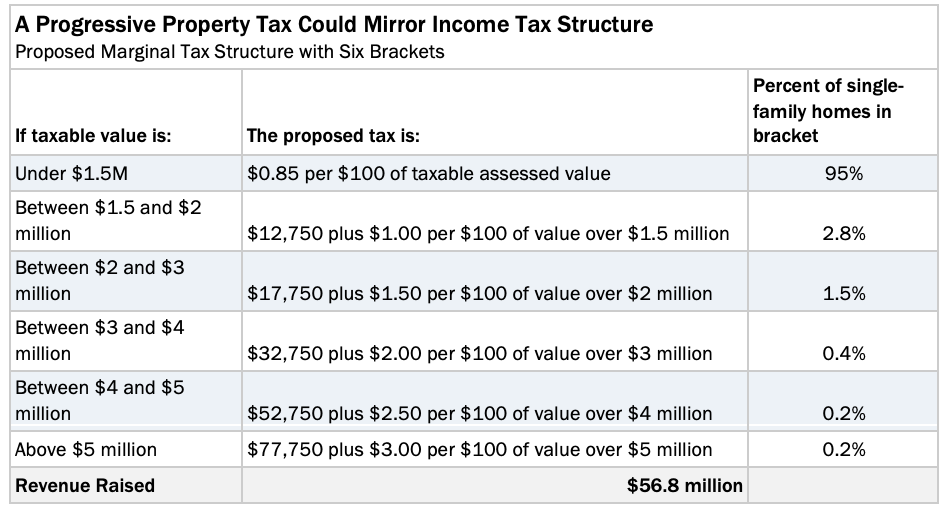

DC can make the residential property tax structure more progressive by splitting District properties into value brackets, each with a progressively higher marginal rate. Raising taxes on homes with taxable value[a] above $1.5 million would impact only 5 percent of homeowners. Lawmakers can protect seniors and homeowners with low incomes by excluding homes where the homeowner receives a homestead-based deduction or credit for seniors, people living with disabilities, veterans, or residents with low incomes.

Revenue prospect: $56.8 million[1]

Tax all realized capital gains at a rate of 13 percent and pair with a credit to offset any tax increase for families in the bottom 80 percent of incomes.

DC taxes capital gains income under the same tax structure that applies to ordinary income, with a top marginal rate of 10.75 percent. DC could tax capital gains separately from ordinary income and at a higher flat rate of 13 percent. This highly targeted proposal would increase taxes on passive income sources like selling stocks, art, or other assets. When paired with an offset, this proposal would only affect taxpayers in the top 20 percent of incomes, with 77 percent of the tax increase paid by those with incomes above $428,000 (the top 5 percent) and about 57 percent coming from those with incomes above $1.2 million (the top 1 percent).

Revenue prospect: $163 million[2]

Eliminate the stepped-up basis for capital gains bequeathed at death.

If a DC resident leaves an appreciated asset to an heir upon death, neither they nor the heir will ever owe capital gains tax on the growth in value up to that point. This tax benefit, called the “stepped-up basis,” allows the wealthy to pass decades or a lifetime of untaxed income to their heirs when they die. This loophole encourages wealthy people to turn as much of their income as possible into assets that will generate capital gains and hold on to their assets until death, and it is one of the key ways that extreme wealth—primarily held by white people—becomes concentrated over generations in America.

If lawmakers raise income taxes on capital gains without eliminating this provision, then the wealthiest taxpayers who are able might be tempted to hold onto their assets for longer periods—longer, even, than is economically productive—simply to avoid the higher tax. This is known as the “lock-in effect.” Removing the stepped-up basis, however, guarantees that those gains will eventually be taxed, thus discouraging taxpayers from deferring their gains for unreasonably long periods.

Revenue prospect: $33 million[3]

Permanently suspend the capital gains tax break for the sale or exchange of a qualified high technology company (QHTC) investment.

The District should permanently suspend any extraneous local exclusions or deductions, like the QHTC, that reduce the amount of capital gains income subject to taxation. These exclusions reduce the base of taxable income without offering economic benefits. While this tax break is currently suspended, it is slated to make a return in tax year 2025. The District should make this suspension permanent and avoid adopting any similar exclusions that reduce revenue for the District.

Revenue prospect: unclear

[a] Many homeowners do not pay taxes on the full assessed value of their homes, which the District assigns based on a range of characteristics, such as size and condition of the building. The assessment is the starting point for a property owner’s tax liability, but deductions and credits may reduce the taxable value of a property.

—

[1] Eliana Golding, “DC Can Advance Racial Equity and Black Homeownership through the Property Tax,” DC Fiscal Policy Institute, October 17, 2023.

[2] Tazra Mitchell, “Taxing Capital Gains More Robustly Can Help Reduce DC’s Racial Wealth Gap,” DC Fiscal Policy Institute, October 31, 2023.

[3] Ibid.