Chairman Evans and other members of the committee, thank you for the opportunity to testify today. My name isEd Lazere, and I am the executive director of the DC Fiscal Policy Institute. DCFPI engages in research and public education on the fiscal and economic health of the District of Columbia, with a particular emphasis on policies that affect low- and moderate-income residents.

Thanks to the efforts of this committee, the District of Columbia has the lowest homeowner property tax bills in the region. Over the past decade, several measures have been adopted to reduce homeowner property taxes and to limit their growth from year to year. This includes a cap on annual increases in taxable assessments, which was first set at 25 percent but since has been tightened to 10 percent. The Homestead Deduction has been increased from $30,000 to almost $70,000 and is now indexed for inflation each year. The property tax rate has been reduced from 96 cents per $100 of assessed value to 85 cents. And several provisions have been adopted specifically to protect seniors and long-term low-income homeowners.

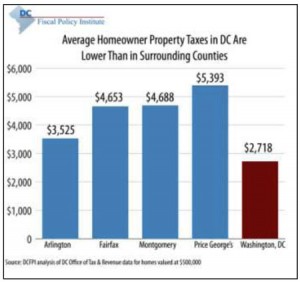

As a result, the property tax rate and actual property tax bills for DC homeowners are far lower than in surrounding jurisdictions, which  have higher rates and fewer benefits. The average property tax for a DC home worth $500,000 stood at $2,718 in 2012, compared with $3,525 in Arlington County, $4,653in Fairfax County, $4,688 in Montgomery County, and $5,393 in Prince George’s County.

have higher rates and fewer benefits. The average property tax for a DC home worth $500,000 stood at $2,718 in 2012, compared with $3,525 in Arlington County, $4,653in Fairfax County, $4,688 in Montgomery County, and $5,393 in Prince George’s County.

It also is worth noting that today, under DC’s 10 percent cap on taxable assessment increases, most DC homes are taxed on less than what their home is worth. The 10 percent cap limits increases in taxable assessments when values are rising faster than 10 percent per year, as happened during the mid-part of the last decade, and this keeps taxable assessments below full assessments.

This year, the typical DC homeowner pays tax on 73 percent of his or her home’s full assessed value. This is pretty amazing considering that nine of 10 homes have faced no change or a drop in their home’s full assessed value since 2008. Because most homes in 2008 had taxable assessments well below their full assessments, many homeowners have faced annual increases in their taxable assessments since 2008, as their taxable assessment started to catch up with their home’s actual value. Yet most DC homes have not had their taxable assessment catch up entirely to their full assessment even after four years. This shows that the 10 percent cap is keeping property taxes low for DC homeowners over the long term.