Thank you Chairman Evans and members of the Committee for the opportunity to offer written testimony on B21-0417, the “First Time Homebuyer Tax Benefit Amendment Act of 2015.” I am Claire Zippel, Housing Policy Associate at the DC Fiscal Policy Institute. DCFPI promotes budget and policy choices to expand economic opportunity for DC residents and reduce income inequality in the District of Columbia, through independent research and policy recommendations.

Increasing homeownership is an important part of ensuring DC families have a path to housing stability and a chance to build wealth. We thus support the intent of this bill, which is to help more people become first-time homebuyers in DC, and we support the District’s current policies that provide deed tax assistance to low- and moderate-income homeowners.

At the same time, we have concerns about the design of the proposed new tax benefit, which would alter and expand DC’s tax assistance for first-time homebuyers. The First Time Homebuyer Tax Benefit Amendment Act of 2015 would give a tax break to all people buying their first home in the District, regardless of their income, the home purchase price, and past homeownership in other jurisdictions. This means that the bill would include high-income households buying very expensive homes, most of whom are unlikely to need assistance to purchase a home. In fact, buyers of high-priced homes would realize the largest tax cut compared with current law. Moreover, the bill would reduce the city’s tax collections and affect the ability to fund other services. In particular, it would reduce funding dedicated to the Housing Production Trust Fund, the District’s main tool for building or renovating affordable housing.

Rather than provide a new tax benefit for all first-time homebuyers, DCFPI recommends that policymakers review the city’s current deed tax assistance to low- and moderate-income homebuyers and make adjustments if they appear warranted.

The District currently helps reduce the financial barriers to homeownership faced by low- and moderate-income households through down payment assistance programs, lower deed taxes for buyers of modestly-priced homes, and abatement of deed and property taxes for low- and moderate-income homebuyers.

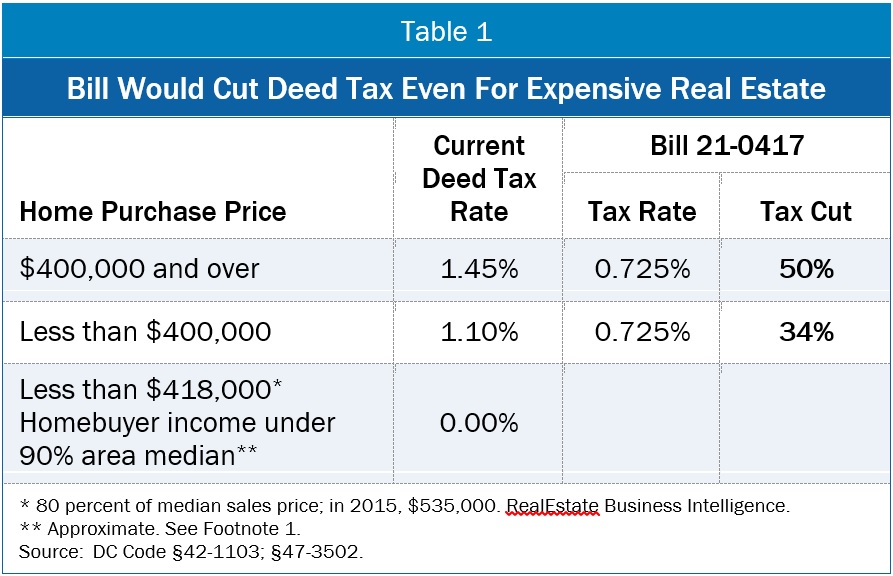

- Lower Deed Tax Rate for Lower- Priced Homes: The current structure of the deed tax is designed to help buyers of moderately-priced homes. Homes sold for less than $400,000 (approximately 75 percent of the median sales price, and a third of the total sales volume in 2015)[1] face a deed tax of 1.1 percent of the sales price. Homes sold above $400,000 are taxed at 1.45 percent. (See Table 1).

- Deed and Property Tax Exemptions for Low- and Moderate-Income Homebuyers: In addition, many low- to moderate-income homebuyers are exempted entirely from the deed tax as part of the Lower Income Homeownership Exemption Program. The program waives the deed tax and provides a five-year property tax abatement for buyers who purchase a home up to 80 percent of the median sales price, and whose income is below approximately 90 percent of the area median.[2] For example, a two-person household with income up to $65,300, or a four-person household with income up to $96,100 would not pay any deed tax if they purchase a home for $418,000 or less.[3]

The current programs are well-targeted to families most likely to need help to buy a home in the District. Only one-fourth of DC households below 90 percent of area median income are homeowners. By contrast, 56 percent of households over 90 percent of the area median already are homeowners.[4]

The First-Time Homebuyer Tax Benefit Amendment Act would add to the existing deed tax assistance programs by establishing a 0.725 percent deed tax rate for all first-time buyers. DCFPI has two concerns with this provision. First, the proposed legislation has no income eligibility limit, meaning that even the wealthiest residents purchasing the most expensive homes in the District would qualify for a tax break. It is unlikely that these households need such assistance to buy a home.

Second, purchasers of high-value homes would actually get a larger tax cut than purchasers of lower value homes. For homes selling for over $400,000, the bill would cut the deed tax rate by half, from 1.45 percent to 0.725 percent. For residents purchasing home for less than $400,000, the bill would cut the tax rate by one third, from 1.1 percent to 0.725 percent. (See Table 1).

If policymakers are concerned that the current deed tax assistance programs are inadequate, the District should look to modify existing programs while keeping a focus on low- and moderate-income families, rather than adopt another tax break that has no income targeting. This could include expanding the Lower Income Homeownership Exemption Program by raising the income or purchase price limit for homebuyers qualifying for deed tax and property tax exemptions.

Finally, we are concerned about the potential impact of this bill on the Housing Production Trust Fund. While the fiscal impact statement is forthcoming, the broad applicability of the tax cut indicates a potentially large loss of deed tax revenue. Reducing revenue from deed recordation and transfer taxes in turn reduces the dedicated 15 percent of such taxes that are transferred to the Trust Fund each fiscal year. Even with the commitment of the Council and Mayor Bowser to direct $100 million to the Housing Production Trust Fund each year, the deed tax remains the Trust Fund’s only dedicated funding source. Constricting dedicated funds will require adding more one-time funding to make up the difference, potentially placing at risk the District’s ability to make urgently needed investments in affordable housing.

We look forward to working with the Committee to explore policies to open homeownership opportunities to more low- and moderate-income residents — such as increasing down payment assistance, sustaining the District’s $100 million investment in the Housing Production Trust Fund, and examining whether current tax relief provisions should cover more low- and moderate-income homebuyers.

Thank you for the opportunity to offer testimony.

To print a copy of this testimony, click here.

[1] Market Statistics, Washington, DC, 2015, RealEstate Business Intelligence.

[2] DC Code § 47-3502 sets the maximum income eligible for the exemption at 120 percent of HUD’s low income definition, which is 80 percent of the area median income. This amounts to income approximately 90 percent of the area median. For income limits by household size, see: The Lower Income Homeownership Exemption Program, DC Office of Tax and Revenue.

[3] Median home sale price, 2015, RealEstate Business Intelligence.

District of Columbia area median income, 2015, Program Income Limits, US Department of Housing and Urban Development.

[4] DCFPI analysis of 2014 American Community Survey data.