The federal mortgage interest deduction—a tax benefit for homeowners with a mortgage— largely benefits the District’s wealthiest neighborhoods and highest-income residents, and costs the city $68 million in foregone local revenue every year.[1] The mortgage interest deduction has come under renewed scrutiny at the federal level, because it is expensive, doesn’t effectively boost homeownership rates, and mostly benefits high-income households. The District should take a close look at the mortgage interest deduction, too, as one of the many hidden policies that benefit higher-income residents and shore up economic inequality.

The federal mortgage interest deduction—a tax benefit for homeowners with a mortgage— largely benefits the District’s wealthiest neighborhoods and highest-income residents, and costs the city $68 million in foregone local revenue every year.[1] The mortgage interest deduction has come under renewed scrutiny at the federal level, because it is expensive, doesn’t effectively boost homeownership rates, and mostly benefits high-income households. The District should take a close look at the mortgage interest deduction, too, as one of the many hidden policies that benefit higher-income residents and shore up economic inequality.

The mortgage interest deduction (MID) is one of many federal tax breaks that is also included in the District’s local tax code. In 2014, the most recent year for which data are available, 333,000 tax filers in DC claimed the MID.[2]

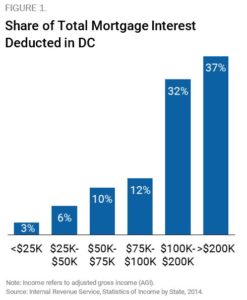

Nearly 70 percent of the mortgage interest deducted was by tax filers with incomes above $100,000. More than a third of the mortgage interest deducted in the District was deducted by tax filers with incomes above $200,000 (Figure 1). [3]

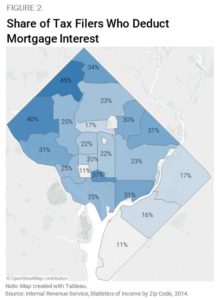

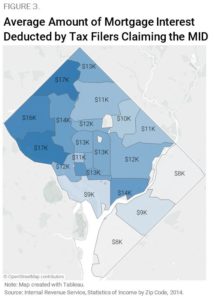

Nearly 70 percent of the mortgage interest deducted was by tax filers with incomes above $100,000. More than a third of the mortgage interest deducted in the District was deducted by tax filers with incomes above $200,000 (Figure 1). [3] About 40 percent of tax filers in the zip codes west of Rock Creek Park—DC’s wealthiest communities—claimed the MID, compared to fewer than 17 percent of tax filers living east of the Anacostia River claimed it (Figure 2). The average amount of mortgage interest deducted by filers who claimed the MID varied substantially across the city, from $17,000 to $8,000 (Figure 3). These differences reflect higher homeownership rates and higher home values in higher-incomes areas.

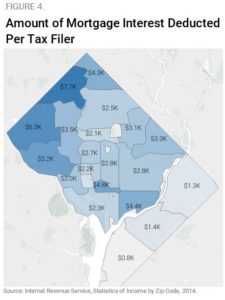

About 40 percent of tax filers in the zip codes west of Rock Creek Park—DC’s wealthiest communities—claimed the MID, compared to fewer than 17 percent of tax filers living east of the Anacostia River claimed it (Figure 2). The average amount of mortgage interest deducted by filers who claimed the MID varied substantially across the city, from $17,000 to $8,000 (Figure 3). These differences reflect higher homeownership rates and higher home values in higher-incomes areas. Putting the two metrics above —share of filers claiming the deduction, and average deduction—together yields the amount of mortgage interest deducted per tax filer (whether claiming the MID or not). This ranges from $8,000 in northernmost Ward 3, to less than $1,000 in the southern part of Ward 8 (Figure 4). By benefiting wealthier, whiter neighborhoods more than lower-income, Black communities, the MID exacerbates both economic and racial inequality.

Putting the two metrics above —share of filers claiming the deduction, and average deduction—together yields the amount of mortgage interest deducted per tax filer (whether claiming the MID or not). This ranges from $8,000 in northernmost Ward 3, to less than $1,000 in the southern part of Ward 8 (Figure 4). By benefiting wealthier, whiter neighborhoods more than lower-income, Black communities, the MID exacerbates both economic and racial inequality.

The mortgage interest deduction has such skewed benefits for three reasons. First, it benefits only those who can afford to own a home. Second, the more expensive the home, the larger the mortgage—and the value of the MID. Third, itemized tax deductions such as the MID are more valuable to high-income people, who have higher federal tax rates and who are more likely to itemize their deductions.[4]

There’s little evidence that the MID has any positive effects. It’s not effective in boosting homeownership, and may even inflate housing prices. The federal mortgage interest deduction is the nation’s seventh-largest tax expenditure, and costs more than every federal affordable housing program combined. For these reasons, the MID has drawn the ire of tax wonks, poverty scholars, affordable housing advocates, and fiscal conservatives alike.

As the District continues to pursue new and expanded policies to increase economic opportunity, the city should also take a critical look at existing policies like the MID that exacerbate economic and racial inequality.

[1] Office of the Chief Financial Officer, Office of Revenue Analysis, Tax Expenditure Report, 2016.

The estimated cost of federal conformity estimates, according to the Office of Revenue Analysis (ORA), represent DC’s portion of the nationwide tax expenditure estimates, using two fractions: “(1) a ratio representing the D.C. share of the relevant activity or population, such as D.C. taxable income divided by national taxable income, and (2) a ratio representing the D.C. average tax rate divided by the U.S. average tax rate.”

ORA also notes that “because of the methodological challenges and data issues, it is important to view the revenue estimates as indicating orders of magnitude rather than providing precise point estimates.”

[2] Tax filing units often, but not always, correspond to households. See Jayron Lashgari, Office of Revenue Analysis, “A Comparative Analysis of Income Statistics for the District of Columbia,” 2015.

[3] All figures in this blog are from the Internal Revenue Service’s Statistics of Income by State and by Zip Code (available here), unless otherwise specified. Throughout this blog, income refers to adjusted gross income (AGI).

[4] In fact, the higher value of the MID to high-income filers is one of the reasons why higher-income filers are more likely to itemize deductions than low-income filers. Even without the MID, however, high-income filers would still be more likely to itemize, according to estimates by the Urban-Brookings Tax Policy Center.