The number of jobs in retail and food service industries grew in the District in 2015 — after the increase in DC’s minimum wage to $9.50 an hour — which means that some of DC’s lowest-paid workers saw both higher wages and better job opportunities. The job growth in DC’s retail and restaurant sectors was better than in the rest of the Washington Metro area, a sign of the strength of DC’s economy.

The first phase of DC’s minimum wage increase went into effect in July 2014, when the wage floor was increased from $8.50 to $9.50 per hour. In July 2015, a second increase to $10.50 per hour went into effect, and a final increase, to $11.50, is scheduled for July 2016. Prior to the implementation of the new law, lower-skilled workers had been finding it more and more difficult to make ends meet. A recent DCFPI report found that between 1980 and 2014, wages have actually declined for all DC residents except those with a college degree.[1]

The minimum wage increases — in tandem with other new worker laws in the District, including paid sick leave, wage theft prevention, and anti-discrimination protections — will help ensure that all DC residents have access to quality jobs. The recent growth in retail and food service jobs is an early indication that these job protections can occur without affecting job opportunities.

Industries with Minimum Wage Jobs Are Growing in DC

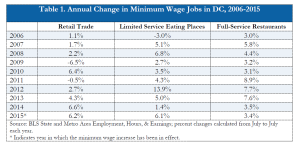

Retail trade and restaurants — especially fast-food restaurants — are major sources of minimum wage jobs in DC, which means that they are two of the industries most affected by minimum wage increases.[2] Job growth in both of these industries was strong during the first phase of DC’s minimum wage increase. See Table 1.

Retail trade jobs grew by 6.6 percent from July 2013 to July 2014, before the first phase of the minimum wage increase, and roughly the same — 6.2 percent — from July 2014 to July 2015, after the increase.

Retail trade jobs grew by 6.6 percent from July 2013 to July 2014, before the first phase of the minimum wage increase, and roughly the same — 6.2 percent — from July 2014 to July 2015, after the increase.- Employment in DC’s limited-service eating places jobs grew only 1.1 percent from mid-2013 to mid-2014, and then grew by a much more robust 6.1 percent in the following year, which was the first full year of the wage increase.

- Full-service restaurant jobs have shown extremely strong growth since 2011. In the two most recent years, growth slowed a bit, but still showed a robust 3.5 percent increase in 2014 and 3.4 percent in 2015.

DC’s Retail and Restaurant Employment Is Increasing as Fast or Faster as in the Suburbs

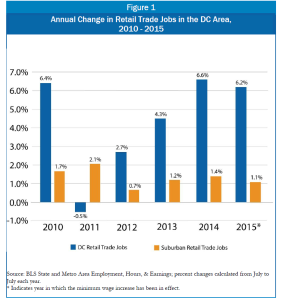

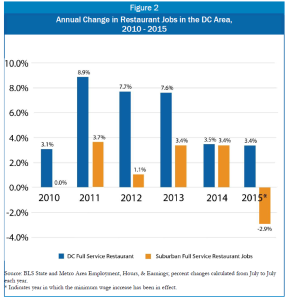

Another way to assess an industry’s strength in DC is to compare its growth to that of surrounding suburbs. The District outpaced the suburbs in employment growth in both retail trade and restaurants in 2015, after the minimum wage increase, continuing a trend of higher growth in recent years. (This analysis compares DC with the remainder of the DC Metropolitan Division, [3] which includes suburbs in Maryland and Virginia).

- Retail: Job growth in DC’s retail sector has generally outperformed the area’s suburbs since 2010, especially in the last two years. Retail jobs in the District increased by 6.6 percent in 2014, before the minimum wage increase, compared with 1.4 percent in the rest of the Metro area. In 2015, after the DC minimum wage increase, retail employment grew 6.2 percent in DC, compared with just 1.1 percent in the suburbs. See Figure 1.

- Restaurants: The Bureau of Labor Statistics provides metro-level data on full-service restaurants, but not on limited-service eating places (which would tend to employ more minimum wage workers).

Nevertheless, a comparison of full-service restaurant jobs in DC and the rest of the metro area shows consistently stronger growth in the District than in the suburbs in every year in the last decade, except for 2014, when growth was about equal. [4] From July 2014 to July 2015, the first year after DC’s minimum wage increase, DC’s restaurants continued to add workers while suburban restaurants were shrinking. In that year, DC’s full-service restaurant jobs grew by 3.4 percent, while jobs in the suburbs actually declined by nearly 3 percent. See Figure 2.

Nevertheless, a comparison of full-service restaurant jobs in DC and the rest of the metro area shows consistently stronger growth in the District than in the suburbs in every year in the last decade, except for 2014, when growth was about equal. [4] From July 2014 to July 2015, the first year after DC’s minimum wage increase, DC’s restaurants continued to add workers while suburban restaurants were shrinking. In that year, DC’s full-service restaurant jobs grew by 3.4 percent, while jobs in the suburbs actually declined by nearly 3 percent. See Figure 2.

These findings show that jobs in both restaurants and retail trade in DC are growing faster than they have in previous years, and growing faster than they are in DC’s suburbs.

This is good news for DC’s minimum wage workers’especially in light of the fact that the city’s economy seems to be finally bucking a decades-long trend of declining wages for lower-skilled workers.

To print a copy of today’s blog, click here.

[1] DCFPI, 2015. “Two Paths to Better Jobs for DC Residents: Improved Training and Stronger Job Protections.”

[2] Although other industries employ minimum wage workers, the Bureau of Labor Statistics State and Area Employment database provides information on higher level NAICS industries only, not broken out by individual occupation. Thus, for this analysis, we only assess the two industries with the highest concentration of minimum wage workers.

[3] For a full list of counties included in the DC Metropolitan Division, visit: http://www.bls.gov/oes/current/msa_def.htm#47894

[4] This analysis highlights changes in fast food restaurants (“limited service eating places”), because they are the restaurants most likely to have hourly workers at the $9.50 minimum wage. (Other areas of the restaurant industry, such as restaurants and bars, employ many workers who are tipped, and therefore do not make the regular minimum wage.) However, the BLS does not break out data on limited service eating places for the DC metro area. So, in order to compare restaurant industry employment trends across jurisdictions, this analysis examines data on full-service restaurants. An analysis by the American Enterprise Institute focused on an even broader category of “food service and drinking places” to assess the minimum wage impact. However, this broader category includes even more employees who do not make the regular minimum wage, and thus is not an ideal way to assess the minimum wage impact. AEI also did not analyze retail employment, even though it is an industry with a substantial number of minimum wage workers.