The proposal by Mayor Bowser to offer $60 million in tax breaks to the Advisory Board Company raises serious questions about whether these kinds of incentives are needed to keep DC’s economy strong. Despite significant efforts by the Bowser Administration to shape a tax subsidy that creates benefits for the District, the tax breaks do not appear to be needed to allow the Advisory Board to succeed in the District, and would be a bad precedent for the city to take.

However, if the DC Council feels that the risk of losing the Advisory Board is great enough to warrant some kind of tax subsidy, the proposal should be changed to ensure that taxpayers get the best bang for their buck out of this deal.

Under the proposal, the Advisory Board would get up to $6 million in property tax abatements a year for 10 years, starting in 2021. In return, the company would have to lease a brand-new building in the District for at least 15 years and add 100 District residents to its payroll every year for the first 10 years of their lease — 1,000 residents in total. In addition, the Advisory Board would have to invest in a variety of community benefits, including volunteer hours at schools and mentorships, and training and workforce development activities for DC residents. Finally, the Advisory Board’s lease would last longer than the tax abatements, so that the company could not leave DC as soon as the tax breaks end.

Despite these important protections, there is a great deal of research showing that companies locate where it makes the most sense in the long-term, and that companies seek tax incentives because they can, not because they are essential to a location decision. In this case, there are signs that that Advisory Board would like to stay in the District. The legislation requires the Advisory Board to sign a lease by December 31, 2015, which means it’s likely that lease negotiations have been underway for some time. In addition, even with this tax break, the lease costs of staying in DC will be greater than in some suburbs, a sign that the Advisory Board sees advantages to being in the city.

These points were echoed in an analysis by the Chief Financial Officer. Their Tax Abatement Financial Analysis concluded that:

- The Advisory Board does not need a tax abatement to maintain operations or to continue its growth. Property taxes only make up 1 percent of revenue and would not be considered a hardship for the company.

- It is likely that Advisory Board will hire 120 new residents a year with or without the abatement, based on their recent growth. Even if the company moves to Virginia, the residency mix of hiring is unlikely to be affected. Many of their new hires will still be DC residents.

Nevertheless, there is a risk that the Advisory Board will leave the city if it does not get additional tax breaks — a move that would have symbolic implications, as well as financial losses for DC in terms of commercial property and corporate franchise taxes. However, the District faces that risk every day. Despite the higher cost of office space in the city, the District consistently has lower office vacancy rates than the suburbs. This suggests that the District does not need to offer tax abatements to keep companies in the city, and that offering a substantial tax subsidy to the Advisory Board only risks setting expectations that any company can get incentives when making location decisions.

If the DC Council agrees with the mayor that the risk of the Advisory Board leaving the city is great, the council should make changes to ensure DC gets the best deal possible. Most important, under the proposed deal, the Advisory Board could get a large share of the tax breaks even it does not meet the hiring goals. This and other shortcomings should be addressed.

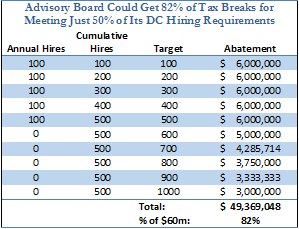

- Tax breaks should be more closely tied to jobs created. The tax break formula proposed by the mayor would allow the Advisory Board to collect a large share of the tax breaks even if it falls short of resident hiring goals. For example, if the Advisory Board increases DC resident employment by 500 in 5 years, and then stops growing, the company could still claim 82 percent of the tax-break package — even though it only met half of the hiring goal. Instead, the formula should be adjusted so that the share of the $60 million received matches the share of the 1,000-job goal met.

- Require good jobs: While the deal calls for new DC resident hires, it says nothing about the annual salaries of those hires. The Advisory Board could staff most of the resident positions at levels below their average pay. Under the best case scenario, DC is paying Advisory Board $60,000 per job, so DC should ensure that the jobs created pay well and have generous benefits.

- Take back the tax breaks if hiring is not maintained: Nothing prevents Advisory Board from terminating the newly created positions after the end of the abatement period (year 10). DC should have some protections built into the deal that ensure that residents are hired for the term of the lease. That could be accomplished with a “clawback” provision to reclaim a portion of the tax breaks if net DC hiring growth falls below 1,000 after the tax breaks end.

To print a copy of today’s blog, click here.