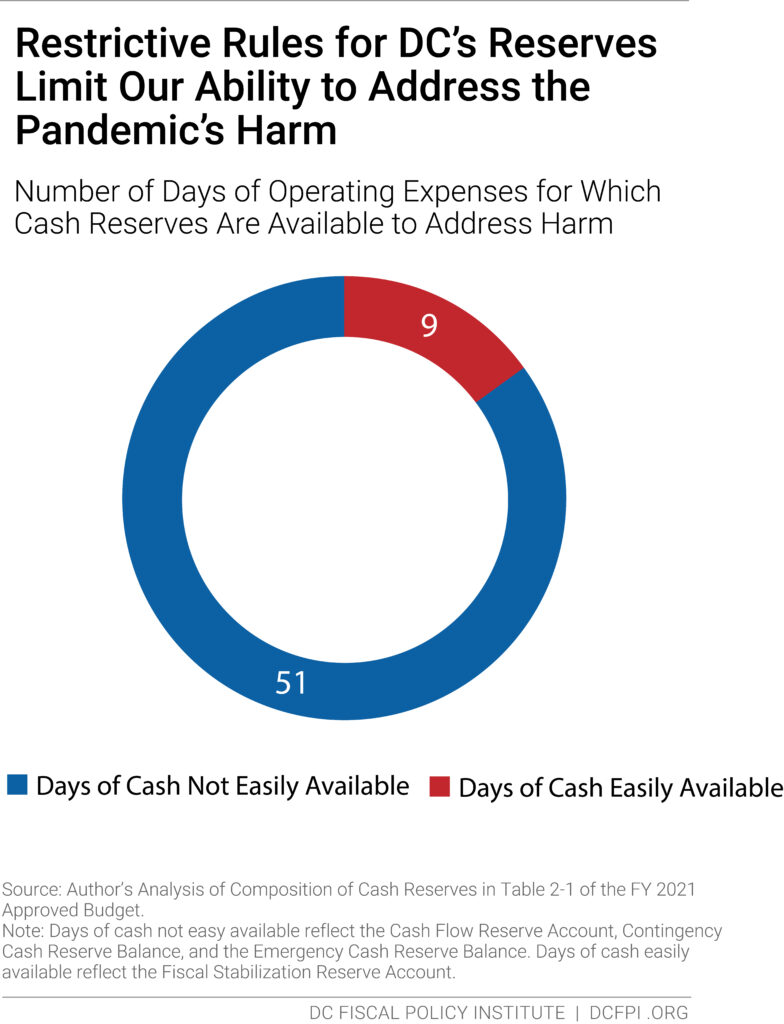

The District built up 60 days of cash to use during hard economic times, but restrictive rules make only 9 days of cash easily available for lawmakers to use to help residents and businesses struggling in the pandemic, according to a new analysis by the DC Fiscal Policy Institute. If the restrictive rules remain in place, the District could be forced to make cuts in services in the upcoming budget, while leaving over $1 billion of reserves in the bank.

The District’s $1.4 billion in reserves available in the approved fiscal year (FY) 2021 budget are spread across four funds. The Mayor and DC Council tapped nearly $213 million in cash from one of the reserves in the FY 2021 budget, but the remaining $1.2 billion is not easily accessible due to overly restrictive rules that limit the other reserves’ flexibility to help address pain during economic downturns.

DC built up these reserves to have cash on hand to meet 60 days of operating expenses available for challenging times, a target recommended by the Government Finance Officers’ Association. Yet restrictive rules essentially leave the District with nine days of easily available cash—rather than 60—even when they are needed most. This defeats the purpose of reaching a 60-day cash reserve (Figure).

The District’s two locally-mandated reserves, which total nearly $950 million in the FY 2021 budget, have completely different rules that govern their availability during a recession and how quickly they have to be replenished.

- The Cash Flow Reserve Account: This almost $730 million reserve (half or about 31 days of DC’s savings) cannot be used as a rainy day fund in a recession, when the fallout of shrinking revenue and increased demand for services stretch beyond a year. This fund is used only for short-term cash-flow needs since any money used must be repaid in the same fiscal year.

- The Fiscal Stabilization Reserve: This fund, which accounts for one-seventh of DC’s reserves and totals nearly $213 million (9 days of revenue), is the only one that lawmakers are currently and readily able to use. This locally-mandated fund is available for use in a recession because repayments come from future budget surpluses. The FY 2021 budget tapped this entire reserve and will begin to replenish it in FY 2023. As a result, no more funds are available from this reserve until FY 2024.

The District’s two federally mandated reserves, which total another $480 million, require repayments to start within a year and be completed over two years, limiting their use in a recession.

- The Contingency Cash Reserve Balance: This $320 million reserve (13.5 days of revenue) is normally used when it is likely that funds can be replenished quickly, such as through a year-end budget surplus or federal recovery dollars. This structure makes the reserve available to the Mayor but is effectively inaccessible to the DC Council in the budget process. While the Mayor uses this reserve frequently, the Council has never tapped the Contingency Reserve on its own.

- The Emergency Cash Reserve Balance: This $160 million reserve (nearly 7 days of revenue) can be used to meet “extraordinary needs of an emergency nature, including a natural disaster or calamity,” or in a state of emergency declared by the Mayor. Lawmakers almost never tap this reserve.

Building up rainy day reserves–and using them in a recession–is smart financial management, because using reserves helps limit budget cuts or tax increases when the economy falters. Cities and states that tap their reserves responsibly have been able to protect their bond rating. Forty states used rainy day reserves in the Great Recession, and 35 kept their bond ratings intact.

How to Improve the District’s Reserve Rules

It doesn’t make fiscal, economic, or moral sense to leave most of our reserves in the bank in this deeply painful recession, when that money could help struggling residents and businesses and limit the recession’s damage to the DC economy.

District lawmakers should amend the Cash Flow Reserve Account rules to allow those funds to be tapped in a recession and repaid from future surpluses. This may require the District to use short-term borrowing for cash-flow purposes, but it would likely cost only a few million dollars in interest payments. The Mayor and Council should also work with Congress to remove the outdated and unnecessary restrictions on DC’s federally mandated Emergency and Contingency reserves. Given that the Control Board disbanded nearly twenty years ago, and DC has managed its finances well, giving DC more autonomy over its finances only makes sense.