The increase in the District’s minimum wage to $11.50 an hour will lift the incomes of thousands of DC residents, according to a new study by the Urban Institute. A significant share of the affected workers affected are at or near poverty, and most are major breadwinners for themselves or their families. This means that the minimum wage increase will help reduce income inequality in DC. What’s more, the study may understate benefits that workers could experience given recent income tax reforms that will reduce taxes for low- and moderate-income households.

The study looks at the minimum wage’s impact on worker’s earnings and on disposable income — the net income gain after taking into account taxes and any reductions in government assistance programs resulting from the earnings increase. It finds that the new minimum wage will:

Affect a large share of workers: 41,000 District residents — or one in eight working adults — will be affected by the new minimum wage. Two-thirds these residents work year round (48 weeks or more).

Help low-income residents: About 55 percent of those affected workers live in households with incomes below or near the poverty line.

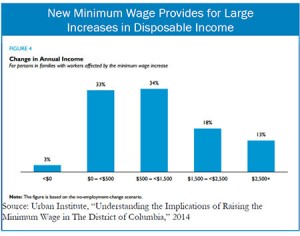

Provide significant increases in earnings and income: Half of these workers will see a $1,500 or larger increase in annual earnings. And the vast majority of workers will keep more than half of their earnings gains as disposable income, after taxes and reductions in government benefits are considered. For example, a single adult without children working full-time will see up to $4,000 increase in disposable income, from $15,700 to $19,700.

The study noted that income increases will be modest for some families, either because they already are earning close to $11.50 or because they receive a number of public benefits that will phase down. But this does not negate the fact that many workers will see notable income gains.

Moreover, the study may understate net benefits to workers. This is because it relies on income tax and public assistance rules from 2011, and, in particular, does not take into account a package of tax changes adopted in July that will cut income taxes significantly for low- and moderate-income residents. That means workers should be taking home much more of what they earn in 2016. These changes include raising of the standard deduction and the expansion of the Earned Income Tax Credit (EITC) for childless adults. The expansion of the DC EITC will be especially beneficial given that most minimum wage workers are single adults without children.

Higher wages and lower taxes means low- and moderate-income families will have more disposable income to spend on essentials like food, school uniforms, or night classes. The benefits of the new minimum wage are exciting, and in combination with recent tax changes, will help make work pay for more District families.

To print a copy of today’s blog, click here.