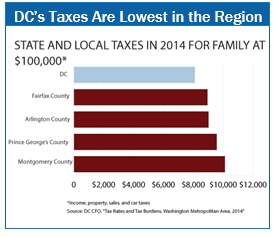

On this tax day, as you may be scrambling to file your returns, remember that DC households pay lower local taxes than in any other part of the DC region. In some cases, DC’s taxes are lower than in the suburbs by thousands of dollars.

These findings come from a recent report from DC’s Chief Financial Officer. They found that DC’s taxes are lowest in the region at every income level studied — from $25,000 to $150,000. Consider a family making $100,000 and the taxes they pay.

- DC’s Property Taxes Are Lowest: A DC homeowner with income of $100,000 pays an estimated $2,100 in property taxes, compared with $2,900 in Prince George’s County, and over $3,000 everywhere else in the region. DC’s residential property tax rate is the region’s lowest, and there are other provisions that limit property tax bills. A homestead deduction reduces the amount of a DC home’s assessment by $71,400, and an assessment cap limits annual increases in taxable assessments to 10 percent, no matter how much a home’s value grows. Virginia has no homestead deduction or assessment cap, while Maryland has both. (A 2015 DCFPI report also shows DC’s residential taxes are lowest in the DC region.)

- DC’s Income Taxes: Lower than in Maryland, Only a Bit Higher than in Virginia: A DC family at $100,000 pays $4,100 in income taxes. That is far lower than the $5,300 paid by families in Prince George’s County and Montgomery County. In Virginia, income taxes at this level range from $3,600-$3,700 depending on the county. That is lower than in DC, but not by much.

Putting these together, and adding in sales and auto taxes, a DC household at $100,000 pays combined DC taxes that are $800 lower than in Fairfax County, $900 lower than in Arlington County, $1,500 lower than in Prince George’s County, and $2,000 lower than in Montgomery County. You can explore taxes in DC and the region further with this neat tool from the Chief Financial Officer.

The taxes we pay as DC residents do a lot of things, from renovating schools, parks and libraries, to ensuring access to health care for almost everyone, to supporting large investments in affordable housing. And we are able to do that with taxes on residents that compare favorably with our neighbors.

Happy Tax Day!

To print a copy of today’s blog, click here.