Chairperson McDuffie and members of the committee, thank you for the opportunity to testify. My name is Tazra Mitchell, and I am the Chief Policy and Strategy Officer at the DC Fiscal Policy Institute. DCFPI is a nonprofit organization that shapes racially-just tax, budget, and policy decisions by centering Black and brown communities in our research and analysis, community partnerships, and advocacy efforts to advance an antiracist, equitable future.

Despite calling for “shared sacrifice” in a time of budget constraints, Mayor Bowser’s budget demands the biggest sacrifices from DC’s lowest income residents, which would set back the progress that DC has made on poverty reduction and greater economic inclusion. As the committee is tasked with matters relating to taxation and revenue, DCFPI urges you to choose equitably raising revenue over balancing the budget on the backs of DC’s Black and brown residents.

My testimony focuses on the mayor’s harmful cut to the DC Earned Income Tax Credit (EITC), the harm of the Chief Financial Officer’s (CFO) overreach on reserves, and taxing all realized capital gains at a higher rate to raise critically needed revenue and make DC’s tax code more equitable.

DC Council Should Restore Planned Increases to DC’s EITC

The mayor’s budget eliminates planned increases in DC’s EITC, reducing the income boost for more than 39,000 families with low and moderate wages by nearly $70 million over the financial plan.[1] Council has expanded this credit over time because it makes a big difference in the lives of workers and their children, helping them keep more of what they earn and meet basic needs like rent and food. It is a powerful tool for advancing racial, gender, and economic equity—and is a major reason DC has the least regressive tax code in the nation.[2] The credit:

- Helps working families—especially those with incomes between $10,000 and $30,000—meet basic needs, like paying for food, bills, transportation, and child care.[3] Nearly 13 percent of families with children and 21 percent of single mother families with children in DC lived below the official poverty line in 2022 (about $31,200 for a single parent family of four).[4] Many more DC families that live modestly above that income level also have difficulty affording necessities. Meeting these needs helps parents keep working and may help them stay employed until better opportunities arise.

- Improves racial and gender equity. Black and brown residents—especially women—are disproportionately likely to be in low wage work and eligible for the EITC. In fact, nearly seven in ten eligible EITC filers in DC are Black and about that many EITC filers or their spouses are women.[5] The credit also goes a long way in helping single parents, who are likelier to be women of color, and research shows it can improve the earnings record of women, resulting in larger Social Security benefits upon retirement.

- Has a lasting effect. Research finds that young children in families with low incomes that get a cash boost like that provided through the EITC tend to do better and go further in school, and work and earn more as adults, likely because the additional resources help parents better meet their needs. Children of color are even more likely to see these improvements.[6]

Under current law, DC will match 100 percent the federal credit by 2026, up from the current 70 percent match, making it the most generous credit in the nation. The mayor’s budget would freeze DC’s EITC at 70 percent, leading to a profound decrease in income for eligible workers compared to what’s been promised. An eligible worker with three kids would see their maximum DC credit go down by approximately $2,230 compared to full implementation in 2026 (using tax year 2023 EITC maximum credits).[7]

While the mayor’s budget raises over $1 billion in revenue, one of the major proposals is increasing the sales tax, which disproportionately harms residents with low incomes. Combined with the EITC backtrack, these proposals would, on net, raise the effective tax rate on DC’s residents with the lowest incomes relative to where it would otherwise be.

DC Council should restore funding to the DC EITC and ensure that the budget doesn’t raise taxes on residents already struggling to get by. The Council should also allow EITC filers to opt out of monthly payments, given it can put receipt of federal benefits, especially food assistance, at risk—a protective measure even more important in a context of deep cuts to human services.[8]

DC Council Should Fight to Replenish Reserves with Future Surpluses

The CFO overstepped his authority by forcing the mayor to replenish reserves more quickly than what DC law requires, blowing a $217 million hole in her budget and resulting in the proposed elimination of critical programs, like the already implemented Pay Equity Fund.[9]

The CFO expressed fear that creditors would downgrade DC’s bond rating if lawmakers didn’t quickly rebuild its reserves to 60 days, according to news reports, but that’s an overly cautious take.[10] Building up rainy day reserves—and using them during hard times—is smart financial management, because it helps limit budget cuts or tax increases when the economy is weak. And, with reserves funded at 85 percent of full capacity and no plans to reduce them, DC’s current reserves management should not be viewed as anything but fiscally sound.

The Council should continue to push back on the CFO and hold its ground that the law allows lawmakers to replenish the Fiscal Stabilization Reserve using future budget surpluses. DCFPI applauds Chairman Mendelson for recently announcing his plans to follow the law and repay the reserve using future budget surpluses. Council could ask the Attorney General for an official opinion on this matter.

DC Council Should Eliminate Tax Preferences and Loopholes that Protect and Further Concentrate Wealth

I participated in Councilmember McDuffie’s roundtable on taxing wealth in 2021—a very important conversation about the role of taxes in closing the racial wealth gap, which is a goal we share. DCFPI has done new research on this topic and highlighted that one equitable way to raise revenue to keep critical programs and services whole and close the racial wealth gap is by taxing DC’s outsized concentration of wealth. In DC, 0.4% of households, or roughly 1,500 households, have net worth over $30 million and hold half of all the wealth in DC, to the tune of $183 billion. A sizeable share of this is held in unrealized capital gains.[11]

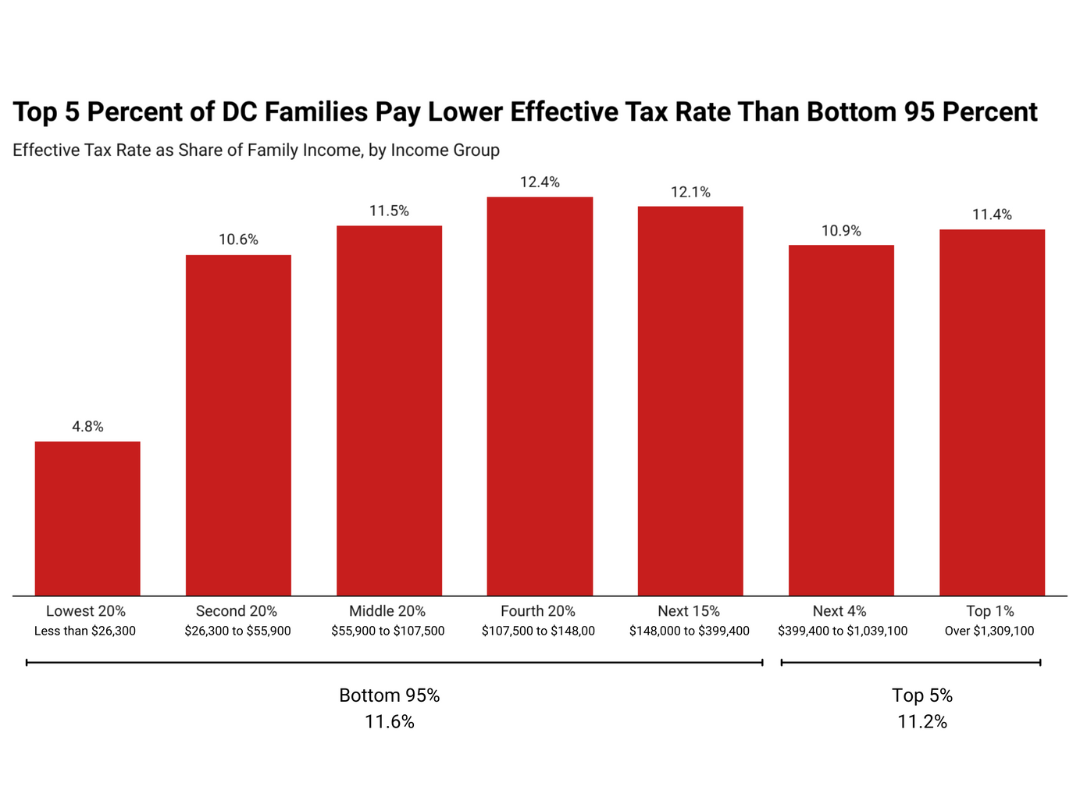

The federal and DC governments tax income from wealth more favorably than income from work, particularly capital gains income, which benefits very wealthy, white households the most.[12] This advantage contributes to the reality that DC’s tax code still favors the top 5 percent, and in the DC area white households have 81 times the wealth of Black households (Figure 1).[13] Racial justice requires unrigging this system, and taxing wealth more heavily, to build a future of shared abundance.

While DC taxes capital gains income at the same rate as income from work, it still allows the wealthy to defer paying taxes on appreciating assets for years and sometimes decades until they are sold and exempts a lifetime of untaxed capital gains income upon death, costing the District tens of millions a year. DC should consider taxing capital gains separately from ordinary income and at a higher rate for taxpayers in the top 20 percent of incomes, along with eliminating the stepped-up basis for capital gains bequeathed at death.[14]

Like wealth, capital gains income disproportionately accrues to high-income, white households. In 2020, for example, less than 1 percent of DC filers reported $1 million or more in federal adjusted gross income, but those filers claimed 71 percent of net capital gains income in the District. This is an even greater share than in the US as a whole.[15] By design, tax advantages for capital gains accrue to a narrow share of wealthy, high-income households, exacerbating income, wealth, and racial inequality. Taxing capital gains would both help correct this inequity and raise revenue for a more balanced budget.

DCFPI recognizes that because of the DC housing market, in which some longtime homeowners may find their homes rapidly appreciating, that wealth accumulation may inadvertently push some households into higher capital gains tax rates. As such, DCFPI is preparing proposals for holding the bottom 80 percent of incomes (as well as low and moderate-income heirs of property) below a certain threshold of gains.

Thank you for the opportunity to testify. I am happy to answer any questions.

[1] Office of Revenue Analysis, “Review of Income Security and Social Policy Tax Expenditures,” August 2021, page 31.

[2] Erica Williams and Nikki Metzgar, “Top 5 Percent of DC Earners Pay Lower Share of Income in Taxes than Bottom 95 Percent,” DC Fiscal Policy Institute, January 9, 2024.

[3] Office of Revenue Analysis, “District of Columbia Tax Expenditure Report,” December 2020.

[4] US Census Bureau, “2022: ACS 1-Year Estimates Data Profiles for DC,” accessed April 22, 2024.

[5] CBPP 2019 estimates prepared using Urban Institute’s Analysis of Transfers, Taxes, and Income Security (ATTIS) microsimulation model and American Community Survey data via IPUMS USA.

[6] Chuck Marr, et al., “EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds,” CBPP, October 1, 2015.

[7] For example, in tax year 2023 the maximum federal EITC for a parent with 3 or more children is $7,430; 70 percent of that maximum credit equals $5,201, about a $2,230 difference.

[8] Tazra Mitchell, “District Must Make Changes to EITC Payments; Prioritize Funding for Baby Bonds,” DC Fiscal Policy Institute, February 13, 2024.

[9] Tazra Mitchell, “CFO Overreach on Reserves Policy May Hurt Black and Brown Women the Most,” DC Fiscal Policy Institute, March 21, 2024.

[10] Alex Koma, “D.C.’s 2025 Budget Process Is Already Off the Rails, Thanks to Behind-the-Scenes Bickering with CFO Glen Lee,” Washington City Paper, March 18, 2024.

[11] Carl Davis, Emma Sifre, and Spandan Marasini, “The Geographic Distribution of Extreme Wealth in the U.S.: Estimating Wealth Levels and Potential Wealth Tax Bases Across States,” Institute for Taxation and Economic Policy (ITEP), October 2022. And, data provided by ITEP to DCFPI in October 2022. Data reflects ITEP’s Microsimulation Tax Model analysis, using data from the Internal Revenue Services, Survey of Consumer Finances, Forbes, and other sources. Ultra wealthy includes those with wealth of at least $30 million.

[12] Tazra Mitchell, “Taxing Capital Gains More Robustly Can Help Reduce DC’s Racial Wealth Gap,” DC Fiscal Policy Institute, October 31, 2023.

[13] Williams and Metzgar, 2024.

[14] For more details on these proposals, see: Mitchell 2023.

[15] Ibid.