The fiscal year 2015 budget includes important tax changes to reduce tax bills for low- and moderate-income families. But the budget left two critical changes ‘ expanding the Earned Income Tax Credit and the income tax standard deduction ‘ on an unfunded “wish list.” Both of these wish list items were recommended this year by the DC Tax Revision Commission.

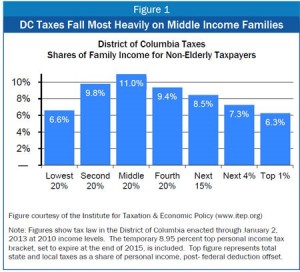

Today, DCFPI testified on the tax changes that can do the most to help bring a better balance to DC’s tax system. This was a major focus of the tax commission, which pointed out that DC’s tax system is unbalanced. Middle income residents pay a far higher share of their incomes in combined sales, property and income taxes than higher-income residents.

The proposed FY 2015 budget would start to address that imbalance with a new lower tax bracket for moderate- and high-income households and by maintaining DC’s top tax bracket for incomes over $350,000, both of which are supported by DCFPI.

However, the proposed budget does not fund two of the Commission’s recommendations to improve the fairness of DC’s tax system.

- DC’s Earned Income Tax Credit for Adults without Children. The DC Earned Income Tax Credit (EITC) reduces taxes and helps make work pay for thousands of District families with children. However, the credit provides very little help to low-wage workers without children. The maximum DC EITC for single workers is $195 ‘ and it’s available only to workers with earnings under $14,000.

The commission recommended expanding the Childless Worker EITC to $500. This would cut the tax bill by 90 percent for a childless worker employed 30 hours per week at $11.50 an hour.

- Increasing the Standard Deduction. The standard deduction in the District’s income tax is available to all residents, but is mostly claimed by low- and moderate-income residents (since higher-income residents usually itemize deductions). Despite its importance, the DC deduction is far lower than the federal standard deduction and similar deductions in many states. Raising the standard deduction to the federal level would do a lot to help low- and moderate-income families and bring balance to DC’s tax system. It would cut taxes for a single parent with two children and an income of $30,000 by nearly one-third, from $950 to $656. After applying the Earned Income Tax Credit, the same family would receive a refund of about $440 with the federal standard deduction, as opposed to a refund of $146 under current law.

Despite the importance of these items, both were include on the mayor’s “wish list” in the FY 2015 budget which would fund items only if the city’s revenue collections rise above current projections. DCFPI asks that the Council include these two measures as part of the FY 2015 budget to help make work pay and make DC’s tax system more progressive.

To print a copy of today’s blog, click here.