Local revenues are rising modestly, and DC is now expected to recover a third of the previously anticipated $1 billion revenue loss from federal layoffs, according to the Chief Financial Officer’s (CFO) new revenue forecast. Corporate profits and non-wage income like capital gains are driving the revenue gains, suggesting that corporations and wealthy residents continue to benefit the most from DC’s economic growth. Although DC is not facing a budget shortfall as some expected, the CFO warns that the District is entering a moderate recession this year—a downgrade from the previously projected mild downturn—before beginning a gradual recovery in fiscal year (FY) 2027. The CFO emphasized that DC’s economy is under significant strain due to new federal policies and continued layoffs.

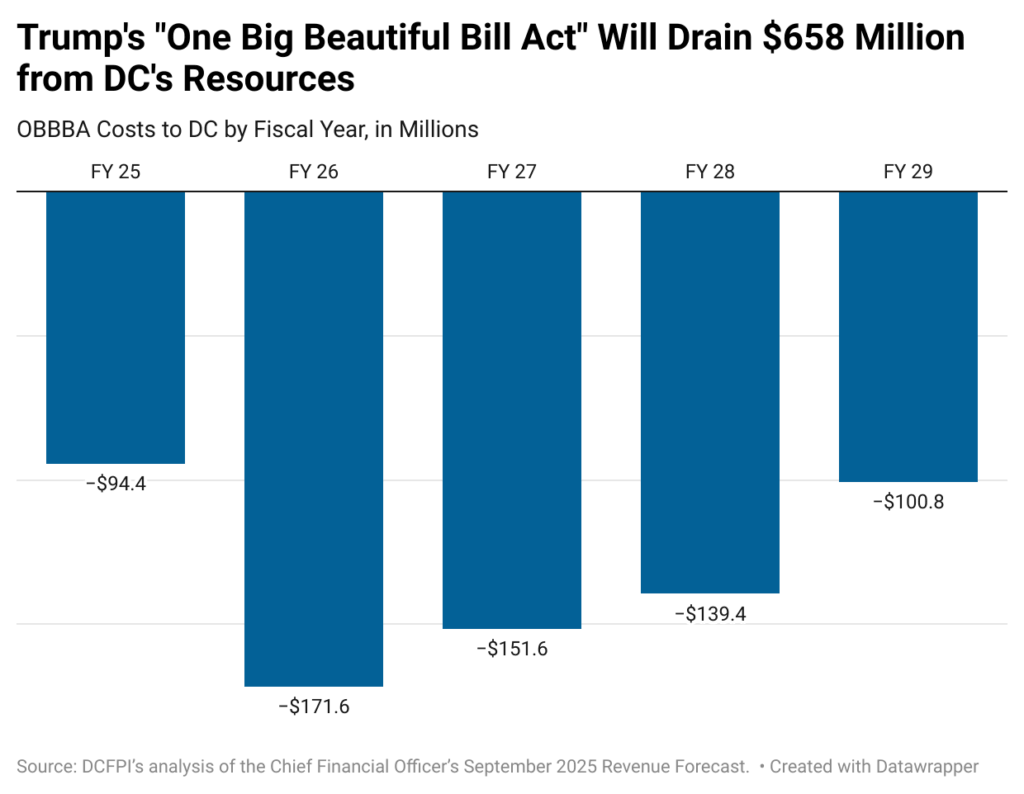

The forecast also signals a new urgency: DC must act quickly to avoid $658 million in revenue losses by decoupling from federal tax code provisions that would result in the new costly federal tax cuts automatically flowing through to DC’s tax code. Failing to decouple from these tax cuts, which primarily benefit households with incomes of $500,000 or more, would severely reduce revenue that DC needs to absorb federal shocks to the local economy, tackle growing budget pressures (some of which are federally driven such as in the case of food assistance), and fund health coverage, affordable housing, and other critical building blocks of a robust, inclusive economy.

DC Revenues Expected to Dip, Especially if Federal Tax Changes Go Into Effect

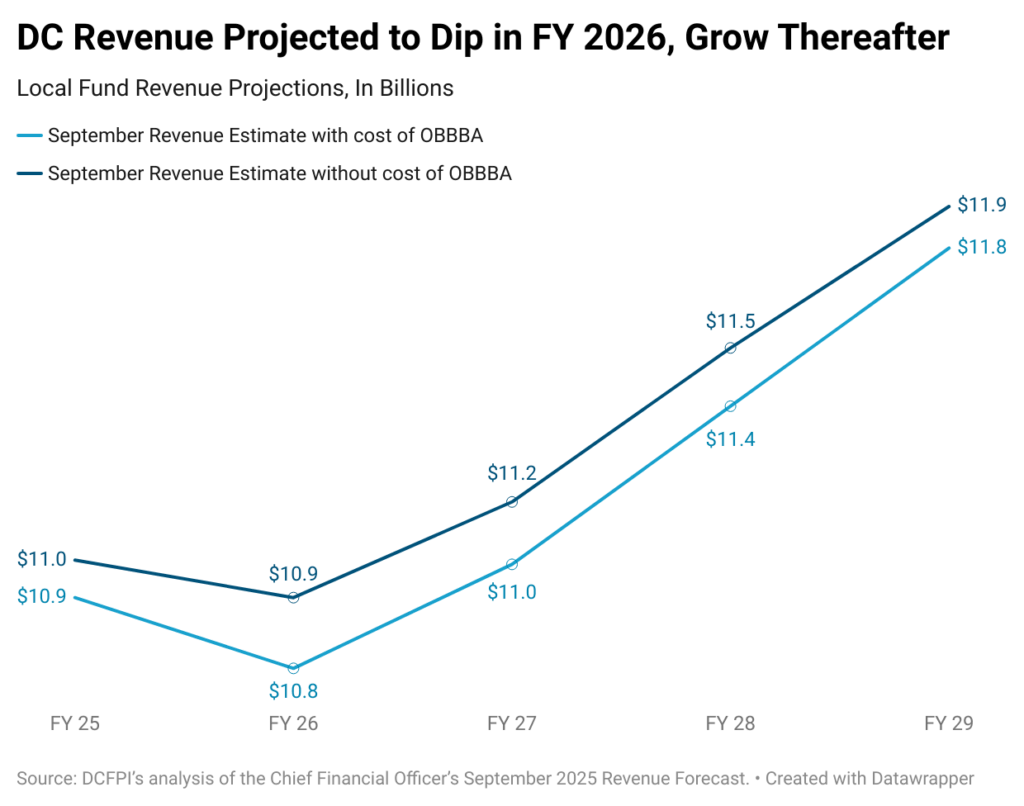

The CFO estimates that local revenues increased by $200 million for FY 2025 and will increase by $721 million over the next four years, compared to the June estimate. However, failing to decouple from the costly federal tax changes included in the One Big Beautiful Bill Act (OBBBA) will temper those gains by $658 million (or over 70 percent), a significant sum that could help keep critical local programs afloat (Figure 1).

Even with the bump in revenue, the CFO projects that revenue in FY 2026 will be 1.6 percent lower than FY 2025 but will grow modestly at an average rate of 3 percent over the next three years (Figure 2). The forecast shows that most revenue sources—like individual income, business income, and sales receipts—will decline in FY 2026 compared to FY 2025, and some sources will begin to rebound in FY 2027.

In February, the CFO projected that DC would lose more than $1 billion in revenue, compared to the December forecast, largely due to federal layoffs. As revenues tick up, that gap is now projected to shrink to $669 million, or by about one-third. The CFO cautioned that federal decisions on issues like trade, immigration, budget, and the federal workforce continue to cause significant uncertainty and volatility in DC’s fiscal outlook.

The Forecast May Trigger Additional Funding for Vital Programs, And DC Lawmakers Must do More to Limit Federal Harm

Revenue growth may trigger additional spending for crucial but underfunded DC programs, like the child care subsidy program and Healthcare Alliance. When the DC Council approved the FY 2026 budget in July, it included a provision that would direct a portion of future FY 2025 revenue growth to fund 11 programs as long as the additional revenues exceed actual expenditures that year as estimated by the CFO. The CFO will certify the additional spending if there is enough excess revenue to close out the fiscal year (once accounting for overspending, for example), as required by law. We’ve seen the CFO reject such lists in the past, even when revenue grew, and it remains unclear whether he will release the funding for this use.

DC faces significant budget pressures due to slower revenue growth, the growing cost of public programs as high inflation and human needs persist, and OBBBA forcing huge costs onto DC via tax changes and administrative costs in safety net programs. DC’s slow revenue growth is likely inadequate to keep pace with budget needs and rising poverty rates, making it an economic imperative for DC lawmakers to immediately decouple from OBBBA tax provisions that put more money into the hands of the wealthy while reducing the funding available for critical programs that support the most vulnerable residents in DC.