Chairman Evans and other members of the committee, thank you for the opportunity to testify today. My name is Wes Rivers, and I am a Policy Analyst with the DC Fiscal Policy Institute. DCFPI engages in research and public education on the fiscal and economic health of the District of Columbia, with a particular emphasis on policies that affect low- and moderate-income residents.

I am here today to comment on the Local Jobs and Tax Incentives Act, which would give the Advisory Board up to $6 million in property tax abatements a year for a 10-year period for staying in the District (starting in 2021). In return, the Advisory Board would have to lease a brand-new building in the District for at least 15 years and add 1,000 District residents to its payroll over the first 10 years of the lease. If the Advisory Board falls short of its hiring goals in a given year, Advisory Board will receive a reduced or prorated abatement. In addition, the Advisory Board must invest in the community benefits including volunteer hours at school and mentorships, training and workforce development activities for residents.

Despite these significant efforts by the Bowser Administration to ensure that a subsidy to the Advisory Board results in net benefits for the District, we believe that these tax subsidies are not needed to keep the Advisory Board in the District and would be a bad precedent for the city to take. DCFPI thus recommends that the tax incentives be rejected.

Research shows that the greatest factors affecting a company’s location include factors such as a skilled workforce and an area’s quality of life, and that taxes largely are not important factors into that decision-making.[1] These points were echoed in the Chief Financial Officer’s Tax Abatement Financial Analysis:

- The company does not need a tax abatement to maintain operations or to continue its growth. Property taxes only make up 1 percent of revenue and would not be considered a hardship for the company.

- It is likely that Advisory Board will hire 120 new residents a year with or without the abatement, as a result of their growth patterns and employment mix. Even if they move to Virginia, the residency mix of hiring is unlikely to be affected.

Beyond that, there are signs that that Advisory Board would like to stay in the District. The legislation requires the Advisory Board to sign a lease by December 31, 2015, which means it is likely that lease negotiations have been underway for some time. In addition, even with this tax break, the building lease costs of staying in DC will be greater than in some suburbs, a sign that the Advisory Board sees advantages to being in the city.

There is no doubt that without the abatement, the District risks losing the Advisory Board to another jurisdiction – which has symbolic implications as well as financial losses with respect property tax and corporate franchise tax revenue. However, the District faces that risk every day. Despite the higher cost of office space in the city, the District consistently has lower office vacancy rates than the suburbs. This suggests that the District does not need to offer tax abatements to keep companies in the city, and that offering a substantial tax subsidy to the Advisory Board only risks setting expectations that any company can get incentives when making location decisions.

That being said, if the District is going to consider giving a tax break, DCFPI believes the structure of the deal provides some important protections for taxpayers and real community benefits. For example, the 15-year lease ensures that Advisory Board will stay in the District beyond the abatement period. With lessons learned through the Living Social Deal, it is also good that the District is requiring that all resident hires will be “net new,” guaranteeing new employment and a larger tax base for DC. If Advisory Board hires one District resident but fires another, they cannot count the new hire towards their hiring requirement.

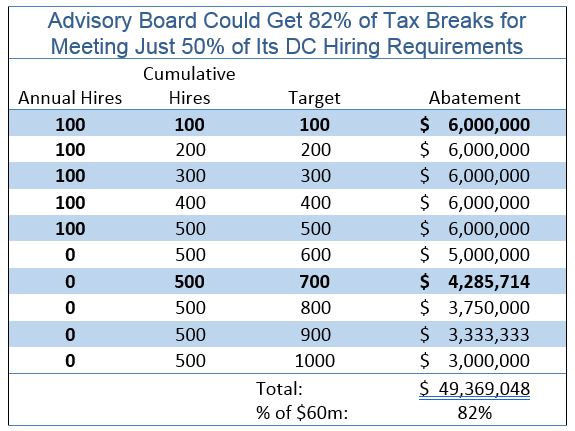

However, if the DC Council agrees with the mayor that the risk of the Advisory Board leaving the city is great, the Council should at least make changes to ensure DC gets the best deal possible. If the Advisory Board does not meet hiring goals in a given year, the city will prorate the abatement in a way that could give Advisory Board more than their fair share.

- Tax breaks should be more closely tied to jobs created. The tax break formula proposed by the mayor would allow the Advisory Board to collect a large share of the tax breaks even if it falls short of resident hiring goals. For example, if the Advisory Board increases DC resident employment by 500 in 5 years, and then stops, the company could still claim 82 percent of the tax-break package even though it only met half of the hiring goal. Instead, the formula should be adjusted so that the share of the $60 million received matches the share of the 1,000-job goal met.

- Require good jobs: While the deal calls for new DC resident hires, it says nothing to the annual salaries of those hires. The Advisory Board could staff most of the resident positions at levels below their average pay. Under the best case scenario, DC is paying Advisory Board $60,000 per job, so DC should ensure that the jobs created pay well and have generous benefits.

- Take back the tax breaks if hiring is not maintained: Nothing prevents Advisory Board from terminating the newly created positions after the end of the abatement period (year 10). DC should have some protections built into the deal that ensure that residents are hired for the term of the lease. That could be accomplished with a “clawback” provision to reclaim a portion of the tax breaks if net DC hiring growth falls below 1,000 after the tax breaks end.

Thank you for the opportunity to testify, I am happy to answer any questions.

[1] Mazerov, Michael, Center on Budget and Policy Priorities, “More Evidence You Can’t Lure Entrepreneurs with Tax Cuts,” February 2014, http://www.cbpp.org/blog/more-evidence-that-you-cant-lure-entrepreneurs-with-tax-cuts