Tax cut “triggers” adopted last year are causing the city’s revenues to grow slower than any time in the last two decades, other than during recessions. This is affecting the ability to meet the demands of a growing city, such as rising school enrollment and increasing homelessness. As the Council prepares to vote on the DC budget, they should modify the triggers to balance tax cuts with the need for adequate revenues to meet important needs.

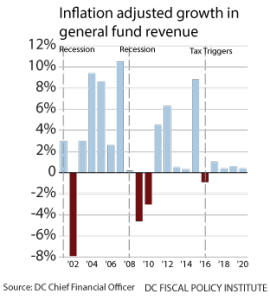

Tax Cut Triggers Are Contributing to Historically Low Rates of Revenue Growth

Tax Cut Triggers Are Contributing to Historically Low Rates of Revenue Growth

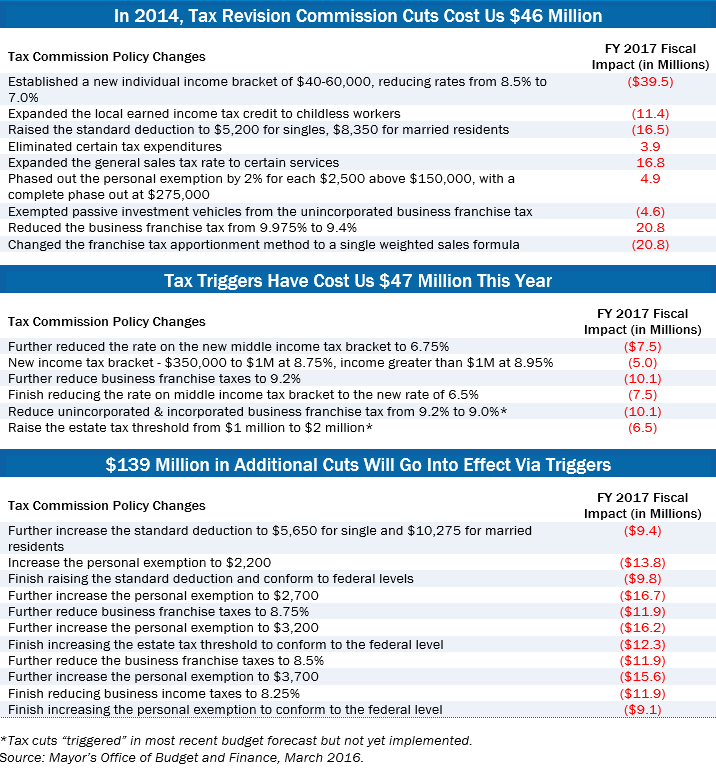

Under the tax cut triggers, 100 percent of any increase in revenues from a growing economy, above revenue projections from the previous year, is devoted to a set of tax cuts recommended by the Tax Revision Commission.

The triggers are greatly restricting the District’s revenues. Revenues will grow no more than 1 percent per year every year from 2016 through 2020, adjusting for inflation. Even in the Great Recession, DC’s revenue growth did not stay this low for so long.

The impact of the tax triggers could last for years. The tax triggers resulted in nearly $50 million in tax cuts over the past year, and nearly $140 million in tax cuts remain to be triggered in the future. (See chart below.)

Tax Cut Triggers Make It Hard to Keep Up with DC’s Growing Needs

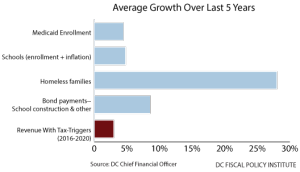

DC’s revenues are projected to increase by just 3 percent per year for the foreseeable future (not adjusting for inflation), largely due to the tax triggers.[i] Yet many needs that affect the city’s budget are growing faster than that:

DC’s revenues are projected to increase by just 3 percent per year for the foreseeable future (not adjusting for inflation), largely due to the tax triggers.[i] Yet many needs that affect the city’s budget are growing faster than that:

- Health Care. Medicaid enrollment has grown 4.5 percent per year over the last five years.[ii]

- School Enrollment. Growing enrollment in DC public and charter schools and a rising cost of living mean that schools have needed 4.8 percent more each year over the last five years.[iii]

- Homeless Services. The number of families in shelter has nearly tripled in the last five years — increasing an average of 28 percent per year.[iv]

- School Modernization and Other Capital Projects. DC’s debt payments have increased 8.6 percent per year over the last five years, due to increased borrowing for school construction and other capital projects.[v]

Tax Cuts Affected the Ability to Meet Needs in the FY 2017 Budget

The $47 million in tax cuts triggered over the past year lead to a fiscal year 2017 budget with modest growth and many gaps. For example, the proposed homeless services budget will not be sufficient to end chronic homelessness in FY 2017, a goal embraced last year. In addition, the proposed budget does not provide any funding to support permanent reforms to the TANF time limit to protect 6,200 vulnerable families who face the loss of all income and employment assistance.

The tax cut triggers will likely contribute to funding gaps in key services for years. With limited revenue growth, it will be hard to tackle challenges such as these.

Tax Cut Triggers Should Be Modified to Balance Tax Cuts with the Need for Adequate Revenues to Meet Important Needs

Moving forward, the tax triggers can be reformed in two ways:

- Delay the implementation of the two most recently triggered tax cuts: a reduction in business franchise taxes, and the elimination of taxes for estates worth between $1 million and $2 million. These tax cuts have not been implemented yet, and thus could be suspended without changing current taxes for residents and businesses. This would free up $17 million that could be used to fund critical services in this year’s budget.

- Longer term, a more balanced approach — one that doesn’t devote 100 percent of revenue increases to tax cuts — should be adopted. For example, for each dollar of new revenue above the baseline, half would be preserved for services and half would go to tax cuts.

The DC Council votes on the Budget Support Act next week. In that legislation, they should include an amendment to reform the tax triggers as listed above. This would go a long way in helping the city to fund critical services at a time of growing needs, while keeping the overall tax cut package intact.

[i] The Mayor’s proposed FY 2017 Budget. Chapter 3: Revenue.

[ii] DC Department of Health Care Finance.

[iii] DCPFI. 2017. “A Changing Landscape: Examining How Public Charter School Enrollment Is Growing in DC.”

[iv] DCPFI FY 2017 Budget Toolkit. “What’s in the Proposed FY 2017 Budget for Homeless Services?”

[v] DCFPI FY 2017 Budget Toolkit. “What Revenue Changes Are in the Proposed FY 2017 Budget?”

To print a copy of today’s blog, click here.