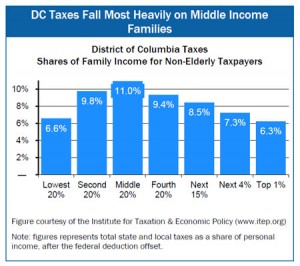

Most DC residents ‘ like most Americans ‘ agree that income tax rates should be graduated by income. Low-income households should pay the lowest rate, so that there is an incentive to work and they can support their basic needs. This kind of progressive approach also means tax rates get higher as incomes rise and as the ability to meet basic needs gets easier. Given the high cost of living in the District, using the tax system to help residents make ends meet is very important.

There is good tax news in Mayor Gray’s proposed fiscal year 2015 budget, including two steps to make DC’s income tax more progressive. Following recommendations of the DC Tax Revision Commission, the budget would lower the income tax rate on moderate income residents and keep an income tax bracket for very high-income residents that otherwise would soon expire.

Unfortunately, however, the proposed budget leaves the Commission’s most targeted income tax cut recommendations on a wish list. In other words,  there’s room for more progress.

there’s room for more progress.

Right now, DC residents who make $40,000 and those who make $350,000 pay the same rate tax rate. Putting moderate-income families in the same bracket as higher-income households contributes to middle-income residents facing substantial tax liabilities as a share of their income ‘ among the highest in the nation, in fact. To address this, the Tax Commission recommended cutting the tax rate for middle incomes ‘ and the FY 2015 budget takes a step in that direction. It would cut income taxes from 8.5 percent to 7.5 percent on income between $40,000 and $60,000, saving a single person $200 and a two-earner family up to $400. The commission recommended dropping the rate to 6.5 percent.

Mayor Gray’s budget also adopts the Tax Revision Commission recommendation to maintain a top income tax rate for residents with taxable incomes above $350,000 rather than letting it expire in 2016 as under current law. The proposed budget would also keep the current top rate at 8.95 percent and not lower it. Maintaining the top rate would generate millions in revenue to support public services and reduce taxes for middle- and lower-income families.

What about help for our lowest-income families? The Council has a chance to help to improve upon the mayor’s proposal by expanding the Earned Income Tax Credit for workers without children or raising the standard deduction or personal exemption. This would help make work pay and help our most vulnerable families meet basic needs. You can read more about the Commission’s recommendation here.

As the Council works to refine next year’s budget, DCFPI will be looking for more progress on recommendations to reduce income taxes for residents who need help to make ends meet in the District.

To print a copy of today’s blog, click here.