The District has done a great job keeping taxes low for poor residents, according to a recently released study. DC’s leaders have put in place many tax provisions to help lower-income residents, who as a result pay a smaller share of their income in taxes than similar families in every state except Delaware. And if DC policymakers implement the remaining recommendations of the 2014 D.C. Tax Revision Commission, DC taxes on low-income families will be the lowest in the nation.

This is something to be proud of. Keeping taxes down helps struggling families keep more of their income and helps them make ends meet in a city with an incredibly high cost of living. The DC Fiscal Policy Institute and the Federal City Council issued a joint statement to trumpet these findings and to thank DC policymakers for making choices that make DC taxes more fair.

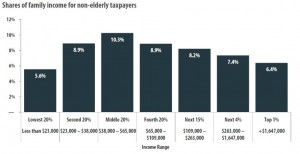

However, the study also found that middle-income DC residents, those with incomes around $50,000, face a higher tax rate than in more than two-thirds of states. Middle-income residents also pay a higher tax rate than DC’s wealthiest. This suggests that while the District has done a lot to keep taxes low for residents living on modest incomes, there is still more progress to be made.

DC families with incomes averaging $23,000 (the poorest 20 percent) pay 5.6 percent of income in DC property, income and sales taxes, according to Who Pays? A Distributional Analysis of the Tax Systems in all 50 States, by the Institute on Taxation and Economic Policy (ITEP). That is well below the 10.9 percent rate low-income families pay in the average state, and lower than every state except Delaware. That means $1,200 lower taxes than if the city’s taxes were at the national average rate.

The District uses a variety of tools to limit taxes paid by low-income families. These include an Earned Income Tax Credit (EITC) that reduces taxes by as much as $2,000 for working-poor families with children, and a tax credit to hold property taxes down for low-income households. Just last year, the DC Council implemented several recommendations of the D.C. Tax Revision Commission (on which I served) that make DC taxes fairer. These include an expansion of the EITC for workers who are not caring for children, and an increase in the standard deduction in the income tax.

The ITEP report also found that DC’s tax rate for low-income families would fall to 5.3 percent, the lowest among the states, if the remaining recommendations of the Tax Revision Commission are implemented. This means that with just a little more effort, DC can be the best in the nation for how low it taxes families with limited incomes.

The findings show that decisions made by DC’s leaders can and have improved our tax system. They also show that through further actions, the city can move even closer to having a tax system that asks the least of residents with the least ability to pay.

To print a copy of today’s blog, click here.