DC Council Chairman Phil Mendelson has proposed implementing important recommendations from the DC Tax Revision Commission over the next five years. The package tackles a troubling imbalance in DC’s tax system, one that leaves middle-income residents paying more in taxes as a share of income than the city’s highest-income residents. Without this proposal, which will be considered when the Council votes tomorrow on the FY 2015 budget, it is unlikely these recommendations will be adopted any time soon.

The chair’s plan also would cut the business income tax rate and exempt estates worth up to $5.25 million from paying taxes. DCFPI opposed these recommendations at the tax commission, because there was no research to show they would improve DC’s economy. Nevertheless, these cuts are a minority of the package’s overall cuts and were part of the commission’s overall compromise, which DCFPI’s Ed Lazere supported as a commission member.

The highlights:

- Tax cuts targeted on low- and moderate-income families: The package expands the Earned Income Tax Credit, reduces the tax rate on moderate incomes, and raises the personal exemption and standard deduction to match federal levels. This would cut taxes by $1,000 or more for moderate-income families. These cuts total $123 million when fully implemented, about three-fourths of the $165 million total package.

- Cut in the business income tax rate: The tax rate for corporations and unincorporated businesses would fall from 9.975 percent to 8.25 percent, matching the Maryland tax rate. This would ultimately cost $40 million per year.

- Tax cuts for wealthy estates: The package would raise the threshold for owing estate tax from the current $1 million to $5.25 million, matching the federal filing threshold. This would cost $14 million.

- Income tax cut for some high-income households: DC’s top income rate of 8.95 percent starts at $350,000 of income. The commission recommended lowering the rate to 8.75 percent. Chairman Mendelson’s package sets a tax rate of 8.75 percent for taxable income between $350,000 and $1 million, while maintaining a top rate of 8.95 percent on income above $1 million.

- Broadening the sales tax to services: The U.S. economy has shifted over time to include more services, which means that a sales tax tied largely to goods becomes less strong every year. Fiscal policy experts recommend broadening the sales tax to include as many consumer purchases as possible. The chair’s package would extend the sales tax to include things like carpet cleaning, health clubs, and billiards parlors and bowling alleys.

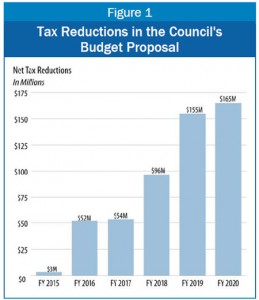

The package would be phased in over time, with just $3 million in net tax cuts in FY 2015. The cost would rise to about $50 million in both 2016 and 2017, about $100 million in 2018, and $165 million when fully implemented in 2020. The revenue loss would be offset entirely by altering the formula for devoting funds to the city’s streetcar project, which currently sets aside more than needed. The new proposal would maintain adequate funding for streetcars while freeing up revenues that can be used for tax reductions. Because the package is implemented over time, it could be adjusted as needed if the city’s fiscal circumstances change.

The Council’s tax package presents a unique opportunity to implement recommendations of the DC Tax Revision Commission and reduce taxes substantially for low- and moderate-income families who struggle to make ends meet and keep up with DC’s high cost of living.

To print a copy of today’s blog, click here.