The final budget vote the Council will hold on June 30 could make it difficult to meet DC’s most basic budget needs a year from now, such as a growing number of schoolchildren, continuing investments in housing and homeless services, and school modernization needs. That’s because the budget legislation adopted preliminarily on May 27 calls for using any growth in revenues through next winter to implement tax cuts from the Tax Revision Commission. Rather than putting next year’s budget at risk, any tax proposal adopted by the Council should designed in way that preserves revenues adequately to pay for the inevitable growth in the costs of basic services.

Using new revenue solely for tax cuts, which total $150 million, is problematic for several reasons:

- Implementing tax cuts so quickly limits the District’s ability to address the rising costs of schools, healthcare, and transportation. The costs of basic services grow every year, due to things like rising health care costs, growing school enrollment, and Metro needs. In 2016, for example, DC’s Chief Financial Officer determined that just maintaining existing services would require an additional $200 million, including over $30 million each to address rising school enrollment and increased support for the Metro system. Rapidly implementing tax cuts over the coming months could make it difficult or impossible to cover the costs of essential services — or to address an unexpected spending need that may arise.

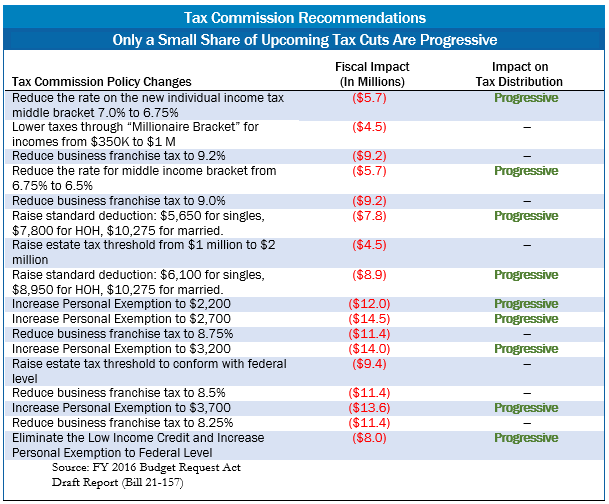

- Many of the tax reductions scheduled next would mostly benefit wealthy residents. While the overall Tax Commission package includes many changes that make DC’s tax system more progressive, by targeting reductions on low- and moderate-income households, that is not the case for the tax cuts next in line. If the District’s revenue forecast shows $50 million in additional revenue, less than half would go to progressive tax changes that help low-and-moderate income residents (See Table). The remainder would go to cutting taxes on estates worth more than $1 million, cutting income taxes for residents with incomes above $350,000 and cutting business income taxes. Yet these tax cuts should not take precedence over funding for services like schools and healthcare.

- The DC Council did not adopt recommended revenue increases that balance the package. The Tax Revision Commission recommended two revenue increases to offset recommended tax cuts, totaling $67 million, which the DC Council did not adopt. This means that the Council’s tax cut plan would limit DC’s revenue growth more than the Tax Commission intended. Given that, it would make sense for the DC Council to spread out implementation of tax cuts to make the impact more manageable.

To print a copy of today’s blog post, click here.