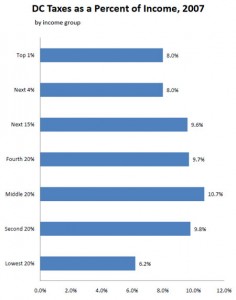

Who pays the most taxes in DC?

You might be surprised. As a percentage of overall income, DC residents who earn between $33,000 and $57,000 pay almost 11 percent of their yearly income toward taxes. This group makes up the middle quintile of earners’between 40 and 60 percent’in the District.

In contrast, the top 5 percent of earners in DC’those who make $252,000 or more’pay only 8 percent. When you add in the federal deduction offset, top earners pay even less.

In contrast, the top 5 percent of earners in DC’those who make $252,000 or more’pay only 8 percent. When you add in the federal deduction offset, top earners pay even less.

So when council members insist that any increase in the income tax reflect a shared burden by all of the city’s residents, they fail to mention that low and moderate income residents already pay more. That’s why DCFPI along with dozens of community, labor and religious organizations supported a one percentage point increase in the income tax for income above $200,000. The proposal brings high-income earners more in line with what low and moderate income residents pay each year in taxes. Plus, recent increases in the sales tax, the cigarette tax, and the gas tax affected low and moderate income residents more than high income residents, because low and moderate income residents spend a greater proportion of their income on these consumer items than high income residents do.

The recent recession severely reduced the city’s revenues. However, in order for the city to emerge from the recession in good shape, we need to continue to support the key investments that have been made in schools, public safety, and human services. To continue supporting the city’s progress, the DC Council ought to critically examine the ways in which it funds the programs that are so vital to the city’s continued growth.

Next spring, the DC Council will once again have the opportunity to signal what direction it intends to lead the city. Numerous councilmembers have explicitly stated over the course of the recent budget debate, that they are open to pursuing new revenues next spring, when the city’s budget situation is expected to be even more dire than it currently is. When the time comes back around for the Council to consider revenue raising proposals, it is vital that they examine how the tax code, as a whole, affects individuals and families at varying income levels. Given that DC taxes fall most heavily on moderate-income families, raising taxes that affect higher-income households — such as new income tax rates for DC’s top earners — is a good place to look first.